IMPROVING INFRASTRUCTURE PROJECT BANKABILITY

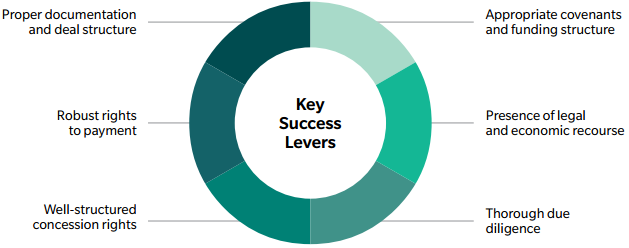

EXHIBIT 15: APRC'S INFRASTRUCTURE PROJECT BANKABILITY GUIDELINES

Across much of Asia, there is an insufficient pipeline of infrastructure projects that meet the bankability requirements of international investors. This issue is a key driver of the infrastructure financing gap in the region and needs to be resolved for a meaningful level of international private sector investment to be channeled towards Asia.

Consistent adherence to the set of bankability guidelines outlined in this report, coupled with the deepening of national capital markets, could markedly change the outlook for infrastructure investment in the region by creating a pipeline of bankable projects. By highlighting the key levers to support the efficient financing and construction of a project in emerging Asia, this set of guidelines is useful to investors, governments, regulators and developers alike.

The burden of responsibility to effect change sits with national governments across Asia. While many countries have begun making changes in line with international best practices, neither the volume nor the pace of change has been enough yet. Institutional investors must also change, but are well placed to do so at a faster rate than governments. They must focus on developing a deeper knowledge base of the respective host countries, else regulatory developments at the provincial levels may render a seemingly viable project at one location unbankable in another.

This section includes two case studies - Central Java IPP (Indonesia) and the Bangkok Skytrain (Thailand) - highlighting how some of these levers can be applied. Further applications of these levers are presented in subsequent sector- and country-level analyses.