KEY SECTORS IN THE REGION

INVESTMENT IN THE ELECTRICITY AND POWER SECTOR IS EXPECTED TO HAVE GROWN BY ALMOST HALF A TRILLION DOLLARS BY 2020

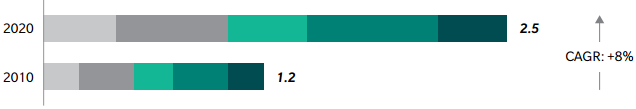

As shown in Exhibit 17, infrastructure spend in Asia-Pacific is expected to reach $2.5 trillion in 2020, more than double the amount from just a decade before. While the electricity and power sector has grown at a strong compounded annual growth rate (CAGR) of 9 percent, all the other sectors are estimated to command a respectable CAGR of 7 to 8 percent as well.

This growth has been supported in part by the development of an increasingly infrastructure friendly environment in many Asian countries. Investment across all sectors has benefited from measures that maintained macroeconomic and political stability; improved legal and regulatory frameworks; increased transparency; and strengthened investor protection.

While the list of key success levers improves infrastructure project bankability across sectors in general, it is essential to note that there are some differences unique to the sectors in which these projects fall in.

For example, power purchase agreements (PPAs) are used in electricity and power Public-Private Partnership (PPP) projects in order to secure payment streams for Build-Own-Transfer (BOT) or concession projects for independent power producers (IPPs). Such guarantees provide for certainty in both the pricing and quantity of power being purchased necessary to make the project viable.28 An additional benefit to a PPA is that the purchaser is able to secure its supply of power. For example, Indonesia's state-owned power company, PT PLN (Persero) has a good track record of successfully financed IPPs and an established form of PPA.38

Additionally, governments regularly seek new ways to fund the development of road networks without having to commit too much of their fiscal spending. Consequently, project finance or PPP road projects are increasingly common. However, a key issue for these road projects is the construction of an appropriate payment mechanism. For example, Australia is home to a number of road projects that failed financially early on in their contract terms due to over-optimistic traffic projections at the time of the bids.39

This section outlines the core characteristics and significant risk mitigants of Asia's key infrastructure sectors.

EXHIBIT 17: ASIA-PACIFIC INFRASTRUCTURE SPEND - SECTOR BREAKDOWN

$ TRILLIONS, 2010-2020

| Rail |

| Road |

| |

| Electricity and Power |

| |||

*1 Includes airports, dams, ports, land control systems, and inland waterway infrastructure

*2 Includes telecommunications, sewage infrastructure, and water infrastructure

Source: APRC analysis of data from Construction Intelligence Center