THE GROWING IMPORTANCE OF ASEAN

ASEAN WILL EMERGE AS AN ADDITIONAL GROWTH ENGINE FOR INFRASTRUCTURE DEVELOPMENT GLOBALLY

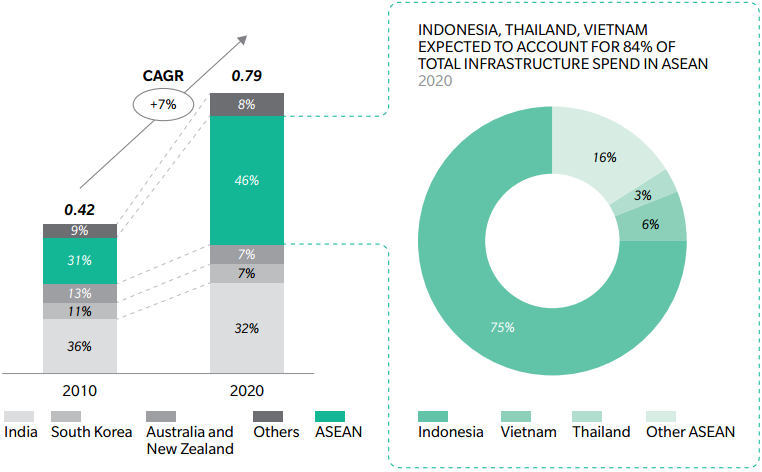

It is expected that in 2020, the Association of Southeast Asian Nations (ASEAN) will make up almost half of total infrastructure spend in Asia-Pacific (excluding China and Japan). Of this, Indonesia, Thailand, and Vietnam are expected to make up 84 percent of the pie. Developed Asia-Pacific countries like Australia, New Zealand, and South Korea, on the other hand, are expected to see slower growth in their infrastructure spend as compared to their developing counterparts (see Exhibit 21).

Political willpower for economic development, positive legal and financial reform, and a push towards greater regional connectivity are just three of the reasons behind the growing expectation that ASEAN will emerge as an additional growth engine for infrastructure development globally.

Indonesia is expected to be the standout ASEAN performer due to positive investor confidence following President Joko Widodo's ambitious infrastructure plan, which is part of the overall Nawacita master plan.

Malaysia, Vietnam and the Philippines are also set to continue growing rapidly and benefit from the general expansion in industrial activity and international trade. Thailand, another member of ASEAN, also posted rapid growth in 2015, as the Thai cabinet made progress in pushing ahead with plans for infrastructure development by launching a "Fast Track PPP" initiative with a Project Advisory Committee similar to that of Indonesia. However, any potential political unrest in Thailand could undermine its appeal to investors.

With this, the following pages delineate the respective countries' infrastructure outlooks, the progressions made by governments, and the remaining challenges in sight. Examples are provided in relation to how some of these reforms are closely linked to the set of key success levers outlined by Marsh & McLennan Companies' Asia Pacific Risk Center.

EXHIBIT 21: INFRASTRUCTURE EXPENDITURE ACROSS ASIAN ECONOMIES (EXCLUDING CHINA, JAPAN)

$ TRILLIONS, 2010-2020

Source: APRC analysis of data from Construction Intelligence Center