4. No tendering

If the State terminates this Deed due to the occurrence of a Default Termination Event (whether any other right of termination then applies) and section 3.1(a)(ii) applies, or a Liquid Market does not or is deemed not to exist under section 3.3(g), or where section 3.3(j) applies, the Default Termination Payment will be calculated as follows:

TP = A - C - D - E - F - G - H + J - M - N

where:

TP = the Default Termination Payment;

A = the Fair Market Value of the Project as at the Compensation Date determined by the Independent Expert on the basis that this Deed and each of the other State Project Documents as existing immediately prior to the Expiry Date had continued until the Final Expiry Date (but for the earlier termination).

In determining item A, the Independent Expert must determine the net present value of the projected cash flows for the period between the Compensation Date and the Final Expiry Date calculated on a nominal pre-tax basis using the rate of indexation forecast in the most recently published State Budget papers and otherwise by:

(i) assessing the market value as though the willing buyer was bidding in a public tender process for the right to enter into a New Contract;

(ii) assuming that:

A. the Project Activities are carried out in accordance with, and to the standards set out in, the PSDR and otherwise in accordance with this Deed;

B. the provisions with respect to payment of the State Contribution, Floating Rate Component and Service Payments continue to apply as provided for in this Deed;

C. any breach of this Deed and any deductions for Abatements occurring prior to the Compensation Date will be disregarded for the purposes of the New Contract; and

D. the Project Documents will be amended as required to reasonably allow for an incoming provider to carry out the Project Activities in accordance with, and to the standards set out in, the PSDR and otherwise in accordance with this Deed;

(iii) taking into account:

A. the costs (if any), and their timing, which are required to be incurred to complete the Works in accordance with this Deed and to achieve Commercial Acceptance;

B. the reinstatement or repair costs (if any) and their timing, including a reasonable contingency against Project risks, required to be incurred with respect to the Project Assets and the Site to enable the carrying out of the Project Activities until the Final Expiry Date in accordance with, and to the standards set out in, the PSDR and otherwise in accordance with this Deed; and

C. any costs, and their timing, required to be incurred to enable the buyer (who is to become the new "Project Co") to carry out the Project Activities in accordance with, and to the standards set out in, the PSDR and otherwise in accordance with this Deed and otherwise to perform Project Co's obligations under the Project Documents,

but excluding any costs in relation to which the State will retain the benefit of a Retention Amount, a Defects Retention Amount, a Handover Escrow Account or a Handover Bond (if any); and

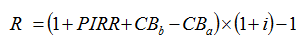

(iv) using a discount rate to calculate the net present value of the cashflows based on the following formula:

where:

R = the discount rate;

PIRR = the pre-tax Project internal rate of return (real) as shown in the Financial Model;

CBb = the real yield to maturity as at the Compensation Date on a benchmark Commonwealth bond traded in the Australian bond markets with a modified duration closest to that of the weighted average life of any outstanding amounts referred to in paragraph (b) of the definition of Project Debt as shown in the Financial Model;

CBa = the real yield to maturity as at the date of Financial Close on a benchmark Commonwealth bond traded in the Australian bond markets with a modified duration closest to that of the weighted average life of any outstanding amounts referred to in paragraph (b) of the definition of Project Debt as shown in the Financial Model; and

i = the assumed long term CPI (or equivalent) indexation rate using the rates of indexation forecast in the most recently published State Budget papers;

C = the Tender Costs (if any) and the State's reasonable forecast internal and external costs of tendering a form of contract(s) for the Project Activities to replace this Deed after termination of this Deed;

D = any Liability of Project Co to the State under the State Project Documents, including all amounts in respect of which the State is entitled to exercise a right of set-off under this Deed (but subject to clauses 43.11(c) and (d) (other than clause 43.11(d)(vi)(E)(3)));

E = any additional costs reasonably incurred by the State as a direct result of the Default Termination Event (but subject to clauses 43.11(c) and (d) (other than clause 43.11(d)(vi)(E)(3)));

F = to the extent the aggregate of all Post Termination Quarterly Amounts equates to a negative number, the absolute value of the aggregate of all such amounts calculated under this Deed. For the avoidance of doubt the Default Termination Payment is reduced where the aggregate of all Post Termination Quarterly Amounts equates to a negative number;

G = any gains which have accrued, or will accrue, to Project Co as a result of the termination of this Deed or termination of any other Project Document;

H = the aggregate of:

(i) Insurance proceeds:

A. that would have been received before the Expiry Date but for an Insurance Failure Event and which if so received would have been, or would have been required to be, applied towards any other component of the Default Termination Payment calculated under this section 4; and

B. received or receivable by Project Co at any time during the period between the Expiry Date and the Compensation Date, except for Insurance proceeds:

1) that are required under the Project Documents to be (and are) applied to repairing or reinstating the Works or the Project Assets; or

2) representing Insurance indemnification of Project Co against liabilities to third parties;

(ii) any other amounts owing to Project Co; and

(iii) any credit balances standing in accounts held by or for the benefit of Project Co on the Expiry Date (other than those amounts which Project Co holds on trust for a subcontractor in those accounts in accordance with the Finance Documents),

in each case only to the extent it has not otherwise been taken into account in calculating the Default Termination Payment under this section 4;

J = any amounts owing by the State to Project Co under the State Project Documents as at the Expiry Date (including amounts of any State Contribution, Floating Rate Component or Service Payments which have accrued but not been paid as at the Expiry Date);

M = any third party amounts paid to Project Co at any time during the period between the Expiry Date and the Compensation Date; and

N = the costs incurred by the State of engaging the Independent Expert to administer this Schedule.

In calculating items A to N, there will be no double counting of amounts. Without limitation, the value of any unpaid State Contribution may be taken into account in item A paragraph (ii)(B) as an amount payable under the New Contract, or in item J as an amount payable to Project Co, but not both.