PPP Investment Booms

The uneven quality of the data on PPP investments complicates our regression analysis. To overcome this, we conduct an event analysis to look at what happened in years after-relative to years before-a particular investment boom. As Warner (2014) puts it, this type of quantitative exercise is a simple way of establishing the stylized facts about the macroeconomic conditions surrounding an investment boom.

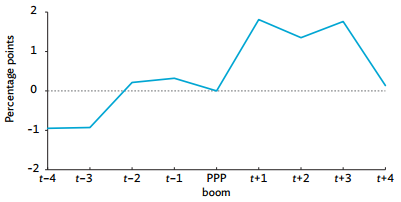

Here, we see that an investment boom-PPP investment (% of GDP) grows for 3 consecutive years-is associated with higher growth. Figure 2.5 shows how real GDP growth per capita is higher after an investment boom relative to the period before it. The positive relationship between PPPs and economic growth could be attributed to the huge capital involved in these projects. Shediac et al. (2008) note that large infrastructure projects generate employment in the short and long term, and crowd in private investment. But the corresponding growth impact in this analysis is rather short-lived. The difference in economic growth reaches more than 2%, but stabilizes 4 years later. Even so, this does not cast doubt on the long-term growth impacts of PPPs, given the expected productivity improvements associated with better infrastructure.

Figure 2.5: Real Per Capita Gross Domestic Product Growth Before and After a PPP Investment Boom

PPP = public-private partnership.

Source: Authors.