The Role of Multilateral Development Banks in Sovereign Risk Mitigation

Substantial debt financing is available for infrastructure projects in countries with investment grade credit ratings, but there is not much investor appetite for PPPs in countries below investment grade and in emerging markets generally. Credit support for infrastructure PPPs projects can be used to mitigate sovereign, macroeconomic, and project-specific risks, which could benefit PPP projects with weak credit profiles (OECD 2017).

Because a government's sovereign guarantees may not be enough to make projects financially viable, MDBs can be catalysts for investment. As the regression analysis indicates, there is empirical evidence to support the role of MDBs in providing credit enhancement. Credit enhancement products

offered by MDBs can be an efficient, targeted form of intervention. They can lower risks to investment opportunities in difficult sovereign environments so that projects become attractive for risk-averse investors and crowd in private capital to finance infrastructure in developing countries (Moody's Investors Service 2017). Many credit-enhancement tools are already available in the market as well as through international financial institutions. ADB (2017) identified comprehensive guarantees covering commercial and political risks as the most important form of credit guarantee (high importance), followed by extended political risk guarantees.

The private sector operations of MDBs offer guarantees, syndications, and risk transfers for private insurers. These cover many risks, including political risk and breach of contract for government payments or reimbursement to lenders in case a project is terminated. These products are typically marketed to sponsors with lenders as the ultimate beneficiary. Private investors see significant value as well as an untapped demand for using these products, especially in lower-income countries trying to increase private participation in infrastructure (Moody's Investors Service 2017). This implies that they could be used more often.

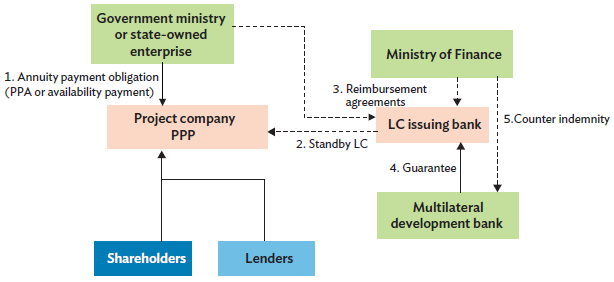

Sovereign partial risk guarantees are another tool that MDBs can use to tackle country risk. These guarantees disburse funds according to preestablished triggers that are legally binding on both the grantor (typically a state-owned enterprise or government agency) and the concessionaire (PPP project company). They also require a sovereign counter indemnity from the government, which defines the government's obligation as well as the penalties that MDBs can apply for noncompliance. Table 7.3 compares guarantee products from the World Bank and ADB, that can be used to backstop government payment obligations in a PPP contract and describes the pricing of the products (if published along with the main beneficiaries). These products were developed by MDBs to cover a wider range of risks than those typically used by the private insurance market, particularly government default on their contractual obligations. In this sense, sovereign partial risk guarantees cover an area between traditional political risk and commercial risk, though they are not a form of political risk insurance (Matsukawa and Habeck 2007). Figure 7.3 outlines the triggering mechanism for sovereign partial risk guarantees with a letter of credit.

Table 7.3: World Bank and ADB Guarantee Options for Government Payment Obligations

| Item | MIGA Breach of Contract | |||

| Guarantee fee | 75 bps | 50 bps | Market | Market |

| Commitment fee | 0 bps | 15 bps |

|

|

| MOF requirement | Counter indemnity | Counter indemnity | None | None |

| Arbitration | None | None | Yes | Yes |

| Credit rating of guarantor | AAA | AAA | Shadow rated | AAA |

| Ultimate beneficiary | Sponsors and lendersa | Sponsors and lendersa | Sponsors and lenders | Lenders |

... = not available, ADB = Asian Development Bank, bps = basis points, IDA = International Development Association, MIGA = Multilateral Investment Guarantee Agency, MOF = ministry of finance, PCG = partial credit guarantee, PRG = partial risk guarantee.

Note: An obligor-rated AAA has extremely strong capacity to meet financial commitments. AAA is the highest issuer credit rating assigned by Standard & Poor's.

a Through a letter of credit, the beneficiary would technically be the letter of credit issuing bank.

Sources: Author; ADB (2011); World Bank (2018).

Sovereign partial risk guarantees have two main advantages over traditional insurance. The first is pricing. The sovereign counter indemnity and guarantee agreement ensures that projects can be priced at a similar interest rate to sovereign loans offered by MDBs. The second is timing. In traditional political risk insurance, the sponsor needs to have an arbitral award to receive payment. A sovereign partial risk guarantee with a letter of credit has the advantage of paying out automatically based on preestablished triggers defined in the PPP contract. These triggers can be linked to key performance indicators that are verified by an independent engineer, whose verification is legally binding on both the government and private partner.

Figure 7.3: Sovereign Partial Risk Guarantee Using a Letter of Credit for a PPP

LC = letter of credit, PPA = power purchase agreement, PPP = public-private partnership.

Note: A default in the payment obligation of the government or state-owned enterprise will result in the on-demand payment of the LC, and the LC issuing bank will then seek reimbursement. The guarantee is called if the reimbursement is not paid within the reimbursement period. The counter indemnity is then called if it is not reimbursed within a period specified by the multilateral development bank; for example, 90 days.

Source: Author.