Expected Economic Effects of Infrastructure PPPs

PPPs are expected to have positive economic effects because they channel private resources into infrastructure spending. PPPs can ease budget constraints and help close demand-supply gaps for infrastructure-a pressing problem for many developing countries in Asia. All in all, PPPs are a good pathway for governments with limited fiscal resources to build more infrastructure. When well executed, infrastructure PPP projects have the same economic benefits as projects financed by traditional procurement in enhancing productivity and delivering social welfare benefits. PPPs have the added benefit of allocating financial risk to the party best able to manage them, and they can actively drive value for money and increase the efficiency of projects.

Even though private investment in infrastructure is increasing, it is not easy to gauge its contribution to economic growth. Using the World Bank's Private Participation in Infrastructure Database, Lee and Rhee (2007) show the relationship between PPP projects and economic growth. They find that infrastructure and total investment have positive impacts on economic growth, but that PPP infrastructure investments do not have a significant relationship with economic growth. Using monthly time series data on the value of construction investment in the Republic of Korea, the authors find that an increase in PPP investment is associated with a decrease in public investment in both the short and long term, and only an increase for private investment in the short term. This indicates a crowding-out effect of PPPs on public investment. Even so, they conclude, this does not necessarily mean that PPPs have no role to play in providing infrastructure. Indeed, were it not for PPPs, infrastructure investment would have fallen significantly in the Republic of Korea during 2000-2006, the period covered in their study. Because PPPs were then at an early stage, a balanced evaluation of their impact on the economy had to wait until more projects were available for study.

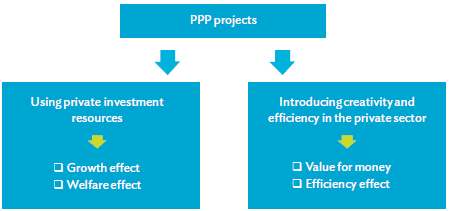

Campos et al. (2003), studying macroeconomic variables in 21 Latin American countries during 1985-1998, found a negative correlation between infrastructure PPP projects and government spending on transport. The findings of this study and Lee and Rhee (2007) suggest that, although PPPs may not have increased infrastructure investments, they contributed to maintaining these investments at a certain level. In the Republic of Korea, infrastructure investment would have fallen sharply had the government not promoted PPPs. Figure 8.1 shows the structural flow of the economic contribution of PPP projects.

Figure 8.1: The Economic Contribution of PPPs

PPP = public-private partnership.

Source: Asian Development Bank and Korea Development Institute. 2011. Public-Private Partnership Infrastructure Projects: Case Studies from the Republic of Korea. Manila and Seoul.

The allocation of risk and improving service quality through a PPP can be achieved through higher value for money and efficiency. ADB and KDI (2011) show that PPPs can have positive ripple effects on an economy by contributing to growth through private capital inputs, enhancing social welfare by the prompt delivery of services and the early realization of social benefits, and reducing fiscal burdens through better value for money. And, when PPP's use advanced financial techniques, they can contribute to developing financial markets.