Empirical Analysis of PPP Projects

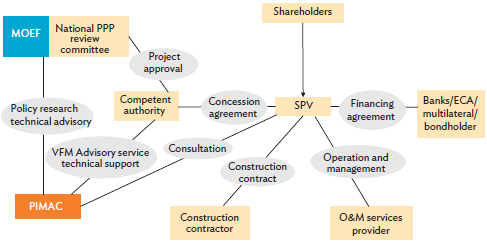

In principle, the structure of a PPP procurement in the Republic Korea is similar to the general PPP schemes discussed earlier. As Figure 9.2 shows, an SPV builds an infrastructure facility using private capital and transfers it to the competent authority; in return, it gets the operation and management right for a predetermined period. The SPV makes a legal agreement with the competent authority, which sets the terms of PPP contracts. The SPV tends to have specific relations with diverse partners or it sources out certain activities to external entities, such as construction companies, operation and maintenance companies, and financial investors. An SPV for a PPP project may often have various partners.

In the Republic Korea, major PPP projects come under the supervision of the Ministry of Economy and Finance and the Public-Private Partnership Review Committee. This is chaired by the Ministry of Economy and Finance, and is made up of officials and private sector experts. The Public and Private Infrastructure Investment Management Center of the Korea Development Institute supports the PPP activities of the ministry and the committee. The center, among other things, provides technical assistance to competent authorities, so that PPPs can be planned and implemented in alignment with the public interest.

Figure 9.2: Structure of a PPP in the Republic of Korea

ECA = export credit agency, MOEF = Ministry of Economy and Finance, O&M = operation and maintenance, PIMAC = Private Infrastructure Investment Management Center, PPP = public-private partnership, SPV = special purpose vehicle, VFM = value for money.

Source: Korea Development Institute, Private Infrastructure Investment Management Center.