Regulatory Functions

PPPs in infrastructure services are often in sectors that either lack competition or are natural monopolies. Where this is the case, tariffs and service standards must be regulated to protect the interests of consumers. Because infrastructure is capital intensive, requiring large investments over long periods, governments may act opportunistically under political pressure. Here, regulation is needed to protect the interests of private partners and investors by curbing opportunistic behavior. Regulatory functions, therefore, aim to balance the interests of all sides in a PPP. Examples of regulatory functions include setting tariff levels, monitoring project operating costs, and setting entry and exit requirements for sector.

Because infrastructure services are essential services, it is important to ensure that they are accessible to the public at affordable prices. Both access and affordability need to be regulated for infrastructure services provided by PPPs. For strategic and national security reasons, some countries impose restrictions on foreign ownership of service providers. The procurement procedure for PPPs, including how projects are prepared, tendered, approved, and implemented, may be subject to regulation to ensure fairness, transparency, and operational efficiency, especially when public resources (financing and assets) are involved.

The roles and responsibilities of the parties involved in PPP transactions may also be regulated. Given the inherent problem of incomplete PPP contracts, which are anyway more complex than private contracts, it is inevitable that disputes between parties arise(Wu, Batac, and Malaluan 2011). While courts can provide dispute resolution mechanisms, the availability of alternative resolution mechanisms can help to increase the confidence of investors (Vandenberg 2015). The renegotiation of contracts may become necessary because of incomplete contracts, and the process and scope of renegotiation can be regulated to prevent opportunistic behavior by the parties involved. Risk allocation is a major aspect of PPP contracts, and this can be regulated to ensure that public and private interests are balanced. Examples of regulatory functions in this area include rules on risk sharing, establishing mechanisms to resolve disputes, and rules for renegotiating contracts.

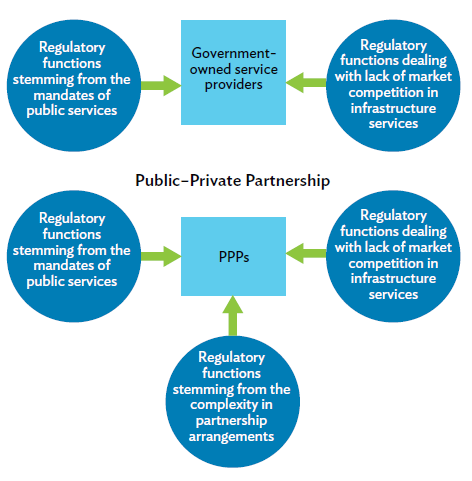

Encouraging private sector participation in PPPs for infrastructure services calls for rebalancing some regulatory functions. The emergence of PPPs in infrastructure services is the result of the deregulation of certain functions. For example, there might be restrictions on private sector involvement in infrastructure services in certain sectors, which means the involvement of the private sector in these sectors is only possible after these restrictions are removed. A further reason for rebalancing regulatory functions is the complexity of PPP arrangements, and new regulations may be needed to deal with this, particularly given the increasing importance of the private sector to help fill Asia's infrastructure gap. Figure 10.1 shows potential changes in regulatory functions caused by the characteristics of PPPs.

Figure 10.1: Chanģes in Reģulatory Functions from Traditional

Procurement to PPPs

Traditional Public Procurement Model

PPP = public-private partnership.

Source: Author.