Southeast Asia's Infrastructure Industry

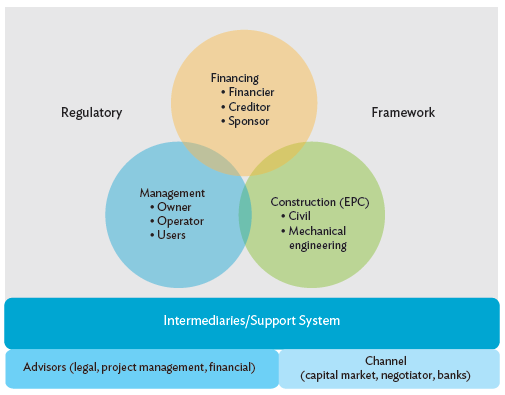

Developing infrastructure needs a system whose components link with one another to support that system. This model of an infrastructure ecosystem has three parts-management, construction, and financing-and this forms the basis of the discussion of Southeast Asia's infrastructure situation (Figure 11.2).

Financing infrastructure is the most challenging part of infrastructure development in Southeast Asia and other emerging regions. Public finance can offer several mechanisms to support PPP projects, such as viability gap funding, tax allowances, and revenue and loan guarantees. To avoid breaching good governance principles, these mechanisms are determined by regulations, typically benchmarked to international standards. A private sector partner who awarded a PPP project will need to raise funds by using equity and making loans to maximize financial returns. This demand is filled by financial providers, such as equity firms, investment banks, creditors, and sponsors.

Figure 11.2: The Infrastructure Ecosystem

EPC = engineering, procurement, and construction.

Source: Author.

In developed economies, financiers are abundant and excellent support systems are in place for PPPs. In developing Southeast Asia, however, there are not enough participants to make the infrastructure industry ecosystem work efficiently. For instance, the size of local currency bond markets in Indonesia, Malaysia, the Philippines, Singapore, Thailand, and Viet Nam is very small compared with Japan and other advanced economies (Table 11.2). As of November 2017, the total local currency bonds in these six emerging markets was only $1.22 trillion compared with Japan, at $10.18 trillion.

Table 11.2: Size and Composition of Local Currency Bond Markets

in Select Countries

($ billion)

Q3 20172017 | Indonesia | Malaysia | Philippines | Singapore | Thailand | Viet Nam | Japan |

Total | 180 | 299 | 102 | 265 | 330 | 46 | 10,178 |

Government | 153 | 159 | 83 | 162 | 239 | 44 | 9,482 |

Corporate | 27 | 140 | 20 | 103 | 91 | 2 | 695 |

Q = quarter.

Source: Asian Development Bank. 2017. Asian Bond Monitor. Manila (November).

The Economist Intelligence Unit's 2014 Infrascope report, which analyzed the readiness of countries in Asia and the Pacific to deliver sustainable PPPs, provides scores on 19 indicators of PPPs. These fall into six categories: legal and regulatory frameworks, institutional frameworks, operational maturity, investment climate, financial facilities, and subnational adjustment factors. This is a useful resource for countries to gauge the effectiveness of their PPP processes, and the results will likely reflect a country's stage of development and economic structure. The ability of countries to efficiently implement infrastructure PPP projects differs from sector to sector. Power generation is usually less complicated because outputs are set out in the PPP and purchasing agreements. But toll roads, especially where they include environmental sustainability components, require lengthier assessment processes and robust demand estimations. If a project is urgently needed, the easiest way is through public procurement or having an SOE carry it out. Several infrastructure projects in Indonesia are being implemented by SOEs through direct assignment.