Solicited Projects

A PPP project initiated by the government covers three stages: project identification and prioritization, project approval, project procurement, and contract award. In the first phase, the project is assessed to ensure that it supports the Philippine Development Plan and sector master plans. Candidate projects are then included in the Comprehensive and Integrated Infrastructure Program, which accompanies the Philippine Development Plan. Both are approved by the board of National Economic and Development Authority (NEDA), the government's central planning agency, and are reviewed annually.

Preparing an infrastructure PPP project begins with the implementing agency conducting prefeasibility analysis. Detailed feasibility studies are then conducted on viable projects. The results determine the type and level of government support; for example, viability-gap funding. Although there are no multiyear appropriations, government agencies handling infrastructure projects are required to submit a 3-year rolling plan on their proposed priority infrastructure investments to the Department of Budget and Management. Before a project can be included in an implementing agency's budget request, approvals from various government bodies are required; these are set out in Table 12.1.

Table 12.1: Approval Procedures for PPPs in the Philippines

| Implementing Agencies | Approving Body | Approval Thresholds |

| National government agencies | Investment Coordination Committee (ICC) | Up to |

| National Economic and Development Authority Board (on ICC's recommendation) | Above | |

| Local government units | Municipal Development Council | Up to |

| Provincial Development Council | From | |

| City Development Council | Up to | |

| Regional Development Council | From | |

| Above |

Source: Korea Development Institute. 2015. A Comparison Study on the PPP System of Korea, Philippines and Indonesia. Sejong.

The next step is to get the approval of government oversight bodies. The Investment Coordinating Committee, which is made of up NEDA officials, evaluates the project's alignment with and contribution to the Philippine Development Plan. The Department of Finance appraises project risk, allocates the fiscal requirements and government debt needed to carry it out, and estimates the financial internal rate of return. It also evaluates the project's impact on fiscal sustainability by assessing the government's direct, contingent, and opportunity costs. The Public-Private Partnership Center of the Philippines (henceforth PPP Center), the main support organization for PPPs and a NEDA-attached agency, conducts value-for-money and financial analyses, and validates the appropriateness of viability gap funding for projects that are economically viable but not financially attractive.

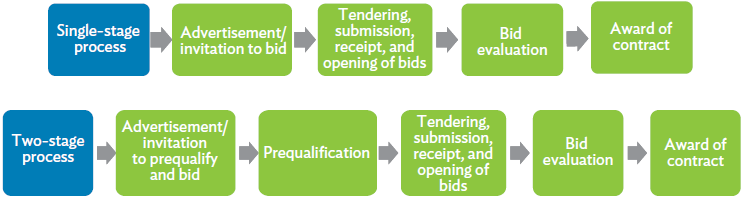

The approval of these oversight bodies is a prerequisite to government budget support for PPP projects and for the project tender itself. Competitive bidding is the default mode for project procurement and awarding contracts in the Philippines. Negotiated contracts are allowed if there is only one complying bidder in a competitive bid, but these are restricted to the financial proposal. The head of the implementing agency is authorized to sign the contract after it has been reviewed by the agency's legal counsel. Department of Finance approval is needed for projects in which the national government has direct and contingent liability. Figure 12.1 shows the procurement process options for solicited PPP proposals.

Figure 12.1: PPP Procurement Options for Solicited Proposals in the Philippines

Source: Public-Private Partnership Center of the Philippines. 2014. National Government Agency Public-Private Partnership Manual. Manila.