Risk Sharing

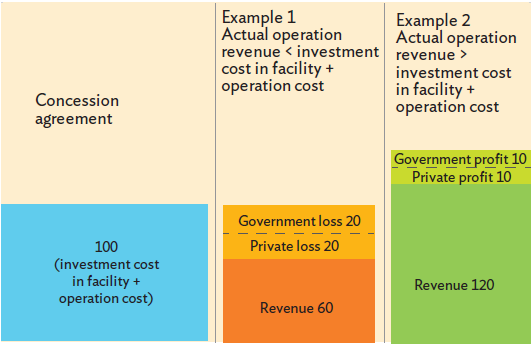

Two risk-sharing schemes for BTO projects were introduced in 2015 to reinvigorate this modality-BTO risk-sharing projects and BTO-adjusted projects. Under a BTO risk-sharing project, investment and operating costs are shared by the government and the private partner at a certain ratio, and both share excess profits or losses (Figure 12.3). If the share of the investment costs between government and private partner is split evenly, the private partner

Figure 12.3: Mechanism of a Build-Transfer-Operate Risk-Sharing Scheme in the Republic of Korea

Source: Ministry of Strategy and Finance. 2015. Public-Private-Partnership Projects Promotion Plan. Sejong.

can receive a certain portion of the operating costs from the government when user demand for the infrastructure facility or service is not sufficient (example 1 in Figure 12.3). But, when demand exceeds the contracted forecast, the government receives a partial return of the private partner's profits (example 2). BTO risk-sharing was introduced to supplement the previous system in which the private sector took on most of the project risk for a BTO, and the government took on most of the risk for a BTL. The fundamental concept of a BTO risk-sharing project is that the competent authority shares a portion of the private sector's investment risk rather than the revenue risk. Under this scheme, private partners bear less revenue risk, compared with standard BTO scheme. This is a way of lowering the rate of return on the government's investment and, ultimately, to lower the user fees.

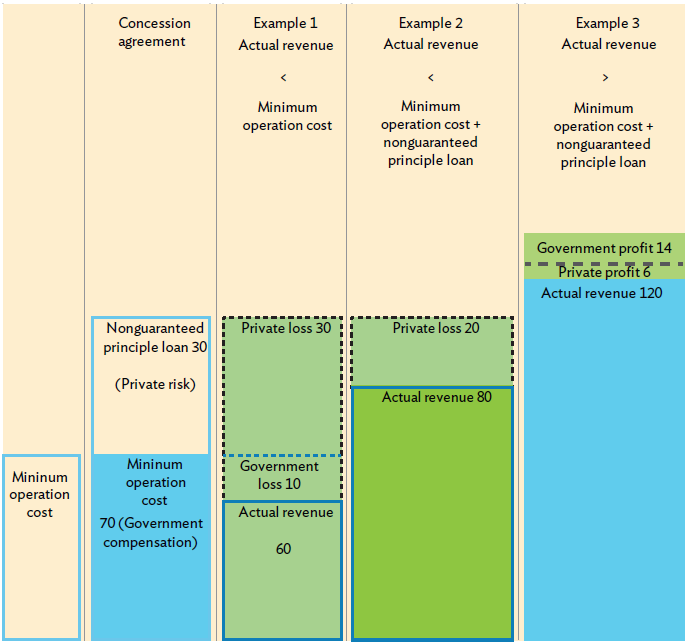

Under a BTO-adjusted PPP project, the government covers the repayment of the principal loan and interest for 70% of the total private investment and shares excess profits with the concessionaire (Figure 12.4). The concessionaire

Figure 12.4: Mechanism of a Build-Transfer-Operate Adjusted Scheme in the Republic of Korea

Source: Ministry of Strategy and Finance. 2015. Public-Private-Partnership Projects Promotion Plan. Sejong.

bears a loss for as long as it is less than 30% of the total private investment. If the loss exceeds 30%, the concessionaire receives government financial support. Excess profits are shared by the government and concessionaire on a 7:3 ratio. The advantage of this system is that it can reduce project risks for the private partner and user fees. BTO-adjusted PPP projects are especially useful for environmental infrastructure, such as sewage and wastewater disposal.