SUMMARY OF METHODOLOGY FOR DEVELOPING THE REFERENCE TOOL

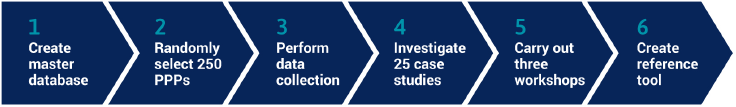

The reference tool has been created using systematic research into the data and actual examples of the practices used during the construction and operations phases of PPPs. The steps in the data collection that helped to inform the reference tool are set out below. In addition, the detailed methodology is described in the Methodology section of the reference tool.

1. A master global database was first developed to include all economic infrastructure PPPs that reached financial close between 2005 and 2015 (inclusive). The master database was built up using multiple online sources and was categorized by region and sector. The master database comprised 3,736 projects across 137 countries.

2. A random group of 250 projects was then selected from the master database, in such a way that the regional and sectoral breakdown of the sample was similar to that of the master database. This was done by selecting a random sample from the master database and comparing the breakdown to that of the master database, repeating this process many times, and finally selecting the sample where the breakdowns best matched.

3. Data was then collected on these projects using a combination of desktop research and interviews with key stakeholders. The information collected covered details of major events (termination, force majeure etc.), renegotiations (number, outcome, etc.), disputes (number, outcome, etc.), as well as basic project information such as contract term, capital value, financing and contractors. The prevalence of issues informed the development of the relevant topics of the reference tool. The limitations to this data collection are detailed in the Methodology and the results are reflected in Appendix A (Data analysis).

4. The existing literature on contract management of PPPs was examined to develop an understanding of what guidance was currently available, including where there were gaps.

5. Once the data collection had progressed significantly, 25 projects were identified as case studies to further investigate particular challenges faced by Procuring Authorities on PPPs after financial close and examples of leading practices and lessons to be learned. The majority of the 25 PPPs were selected from the 250 randomly selected projects, with some others added to ensure a wide range of projects across various regions and covering all relevant issues. Interviews were carried out with the Procuring Authority and Project Company for each case study, as well as with lenders and lawyers where appropriate, to form a comprehensive view of the successes and challenges affecting the PPPs studied, as well as the practices adopted. Further non-project specific interviews were also conducted with experts in the field who have experience in the contract management of PPPs in their relevant capacities as lawyers, lenders, advisors and consultants. Norton Rose Fulbright, a global law firm with staff in 33 countries, also led a substantial legal review of a draft version of the reference tool; inputs from that review have been incorporated into this version.

6. Once a substantial number of case studies had been completed and a draft version of the reference tool had been developed, three regional workshops were held, to share the preliminary findings and to gain further insight from PPP practitioners into their challenges during PPP contract management. The first workshop was in Bogota, Colombia; the second in Singapore; and the third in Rome, Italy, with attendees from regional Procuring Authorities, private sector organisations as well as multilateral development banks. Feedback and additional lessons learned from the workshops were then incorporated into the final reference tool.

The reference tool is therefore based on real experiences on live projects around the world, with support and feedback from the Procuring Authorities as well as other stakeholders including Project Companies, equity investors, lenders and contractors. The reference tool has been structured such that it addresses the prevailing challenges and issues in the contract management of PPPs.

The majority of the 25 Case Studies are shared in Appendix B (Case Studies). Because of the sensitivities of ongoing projects (e.g. some may be experiencing disputes), not all Case Studies are currently available for publishing in full detail. For this reason, a selection of the Case Studies has been anonymised or omitted entirely. However, the fundamental lessons learned from all 25 Case Studies have been incorporated into the reference tool.

Because of the timeline selected for projects to be studied - that being projects which reached financial close between 2005 and 2015 inclusive - the implication was that very few of the projects investigated had reached handback. Guidance is still provided for this process, as it is an important aspect of the management of a PPP; however, the sections covering final handback are not informed by specific case studies.