Causes of renegotiation

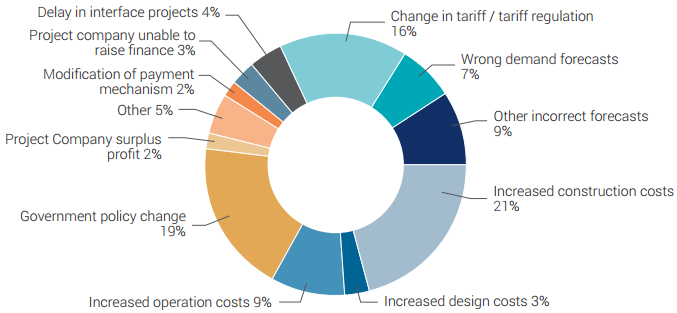

Figure 1 depicts the causes of renegotiations recorded on the 48 PPPs globally where renegotiation occurred. This section analyses the causes of renegotiation, including commentary on which party is most likely to commence renegotiation for specific issues.

Figure 1: Causes of renegotiation, based on 48 projects that experienced renegotiation

The causes of renegotiation in the study were varied, with the most common cause being increased costs. In 17 projects the renegotiation was due to increased costs (12 during design and construction and five during the operations phase), while another nine were due to a change in regulation or policy change. A further nine were due to modification of the payment mechanisms and/or a change in tariff. Five were due to incorrect demand forecasts, including in the Queen Alia International Airport Expansion Case Study, where the actual volumes were higher than predicted. Another common cause was delays to interface projects, such as a high speed rail link which relied on the construction of an adjoining high speed rail project, which was delayed.

Renegotiation in the energy sector was mostly caused by a change in tariff, while the causes in the transport sector covered all of those described above.

The party initiating the renegotiation was split evenly between the Project Company and the Procuring Authority. This was the case both overall, and within Europe and Latin America (the two regions with significant numbers of renegotiations).

The study confirmed that the Project Company often initiates a renegotiation when it is facing financial difficulty or potential insolvency. The main causes of this financial stress were increased construction costs (though increased design or operating costs also played a role) and incorrect demand forecasts.

Factors that may affect costs and revenues and lead to renegotiation include aggressive bidding, and a lack of preparatory studies which increases construction risk. They may also be related to weak contract monitoring, or the Project Company's perceived leverage to influence the Procuring Authority to grant them additional benefits through a renegotiation.

The study showed that the main causes of a Procuring Authority initiating a renegotiation include a change in tariff or payment mechanism, followed by government policy changes and changes in scope. Internal drivers from the government include elections, where the new administration changes the underlying policies around PPPs, or changes in user demands over the level of service or the price of the service leading to public unrest. A road project in Latin America (not covered in detail in the study) experienced the latter situation, where public objection of the toll rates meant the Procuring Authority had to renegotiate the PPP contract to adjust for a lower available toll rate.

Renegotiation can be brought about by external drivers such as significant changes in economic circumstances, including macro-economic conditions beyond the control of the parties, or unforeseen natural events or disasters. Renegotiation instigated by the Procuring Authority for several highway PPPs took place in the Republic of Korea (also not covered in detail in the study) to share the benefits of refinancing.

Both parties are likely to resort to renegotiation in the case of poorly written contracts and ambiguous risk allocation.

Although both parties can have reasonable and legitimate reasons to initiate a renegotiation due to any of these reasons, they also sometimes seek an opportunistic gain through renegotiation. This issue is detailed in Section 4.3 (Guidance).

EXAMPLE Highways in India The research indicates a high risk of renegotiation on highway PPPs in India. This is often adopted as a solution to disputes about increased construction costs due to a failure to secure right of way and land acquisition on time, or due to utilities diversion. |