7.3. Build-Operate-Transfer

| BOT typically relates to greenfield asset developments where the risk allocation to the private sector may be significant, including volume risk, finance risk, and potentially price risk. A number of BOT variants are possible depending on the allocation of roles and risk. These include DBO, DBFOT, BOOT, DBOOT, BOO, etc. |

|

| Note: The distinction between a BOT-type arrangement and a concession, as the term is used here, is that a concession generally involves extensions to and operation of existing systems, whereas a BOT generally involves large "greenfield" investments requiring substantial outside finance, for both equity and debt. However, in practice there is some overlap, as a concession contract may include the development of major new components as well as extensions to existing systems, and BOTs sometimes involve the expansion of existing facilities. Internationally, there is a distinction between area concessions and BOT. Area concessions are typically "Greenfield" projects while "brownfield" projects are normally BOTs. In India, area concessions are called BOT concessions. For instance, all roads that are being developed under a BOT framework are brownfield projects. Source: Knowledge Series, Training of Trainers, PPP, Module 1 |

| Prevalent PPP Models • User-Fee Based BOT models: Medium to large scale PPPs have been awarded mainly in the energy and transport sub-sectors (roads, ports and airports). Although there are variations in approaches, over the years the PPP model has been veering towards competitively bid concessions where costs are recovered mainly through user charges (in some cases partly through Viability Gap Funding from the Government). • Annuity Based BOT models: These models are seen in sectors/projects not amenable to sizeable cost recovery through user charges, owing to socio-political-affordability considerations. Typically, rural, urban, health and education sectors are the ones where these factors are an issue. In this model, the Government harnesses private sector efficiencies through contracts based on availability/performance payments. Implementing the Annuity Based BOT model will require the necessary framework conditions, such as a payment guarantee mechanism made available through multi-year budgetary support, a dedicated fund, or a letter of credit etc. The Government may consider setting up a separate window of assistance for encouraging annuity-based PPP projects. A variant of this approach could be for the Government to make a larger upfront payment (say 40 per cent of the project cost) during the construction period. • Performance Based Management/Maintenance contracts: In an environment of constrained economic resources, PPPs that improve efficiency or involve performance based management or maintenance contracts of existing assets are very relevant. Sectors amenable to such models include water supply, sanitation, solid waste management, road maintenance etc. • Modified Design-Build (Turnkey) Contracts: In traditional Design-Build (DB) contracts, the private contractor is engaged for a fixed-fee payment on completion. The primary benefits of DB contracts include time and cost savings, efficient risk-sharing and improved quality. The Government may consider a turnkey DB approach with the payments linked to the achievement of tangible intermediate construction milestones (instead of a lump-sum payment on completion) and short period maintenance/repair responsibilities. Penalties/incentives for delays/early completion and performance guarantees (warranty) from the private partner may also be incorporated. Subsequently, as market sentiment turns around, these projects could be offered to the private sector through operation-maintenance-tolling concessions. |

| PROJECT | Tuni Anakapalli Road Project Public Entity: National Highways Authority of India Private Partner: Special Purpose Vehicle GMTAEPL Objective: To improve design, construct, operate and maintain the National Highway road stretch from Tuni to Anakapalli Contract: BOT annuity contract for 15 years granted to private partner Ownership of Assets: No transfer of ownership O&M Responsibility: Transferred to private partner Construction/Finance: Works by private partner-private player invested in development of the road stretch and later operated and maintained it. Commercial arrangement: Source of income for the private partner is the annuity payable to the private partner by NHAI. Source: http://toolkit.pppinindia.com/ports/module3-rocs-taarp1.php?links=taarp1 |

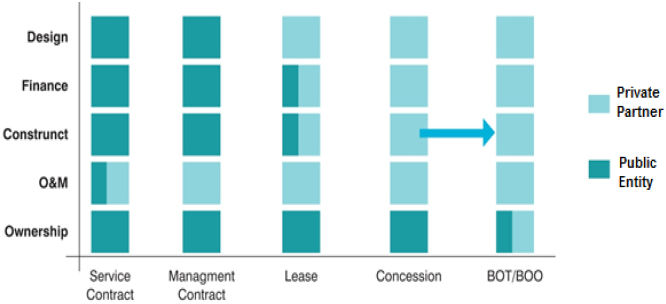

It is to be noted that the level of project related risk which is transferred from the public entity to the private partner increases from a service contract to a BOT contract. For instance, in the service contract which is more akin to outsourcing, only a portion of the O&M risk is transferred to the private partner whereas in a management contract, the entire O&M risk including revenue risk is transferred to the private partner. In both cases, the design, finance and construction risk along with the ownership of assets remains with the public entity. In a lease, the public entity transfers the design and O&M risk along with a portion of the financing and construction risk to the private partner. In such an arrangement, the private partner is expected to share a portion of the user fee collected from the consumers/ users as lease fee to the public entity. In both area concessions and BOT, almost every project related risk is transferred to the private partner; the ownership of assets at all times lies with the public entity. It is only in a BOO framework that the ownership of assets gets transferred to the private partner and in a BOOT framework the ownership of assets gets transferred to the private partner for a certain time period.

The transfer of risk from the public entity to the private partner in various PPP models is set out in the diagram below:

| Variants in PPP Models • Operation & Maintenance (also called Service Provision) (e.g., Specific customer services) contract is a format where the private operator, under contract, operates a publicly-owned asset for a specified term. Ownership remains with the public entity. • Lease, Develop, Operate contract is where the private operator contracts to lease, manage and operate a Government-owned facility and associated services. The partner may invest further in developing the service and provide the service for a fixed term. • Design-Build-Finance-Operate-Transfer (DBFOT) contract is where the private sector designs, finances and constructs a new facility under a long-term lease, and operates the facility during the term of the lease. The facility is transferred back to the public entity at the end of the lease term. • Buy-Build-Operate (BBO) involves the transfer of a public asset to a private or quasi-public entity usually under contract that the assets are to be upgraded and operated for a specified period of time. Public control is exercised through the contract at the time of transfer. • Build-Own-Operate (BOO) is when the private sector finances, builds, owns and operates a facility or service in perpetuity. The public constraints are stated in the original agreement and through on-going regulatory obligations. Annexure 2A of this Module sets out a table with PPP modal families and main variants. |