6.2. Conventional Means of finance

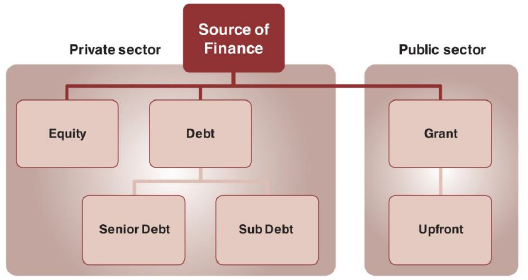

Conventional means of finance primarily include equity or debt (borrowings). In addition to the two, the Government can also contribute towards project development in the form of grant support.

While arrangements for equity and debt support are taken care of by the private partner, the grant support is generally provided by the public sector.

The flow of finances into project development follows a certain sequence. It is only after the infusion of substantial equity capital by the private partner that the sanctioned debt for the project is released. Further, Government support, extended in the form of grant, follows the achievement of pre-determined milestones as set out in the terms and conditions of the agreement signed among the Concessionaire, GOI and the Lender.

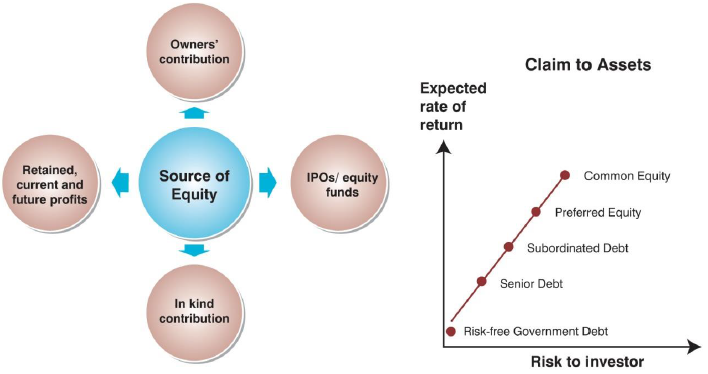

| Equity Equity is generally provided by the consortium members of the project partner for the PPP project. Other stakeholders like contractors, development partners or the public entity could also provide equity. Any project losses are borne first by the equity investors, and lenders suffer only if the equity investment is lost. This means equity investors accept a higher risk than debt providers and hence, require a higher return on their investment. A diagram showing the claim of different sources of funds on the project assets is provided below. |

|

Source: PPP- A Financier's Perspective by Transport Policy and Tourism Division, UN ESCAP

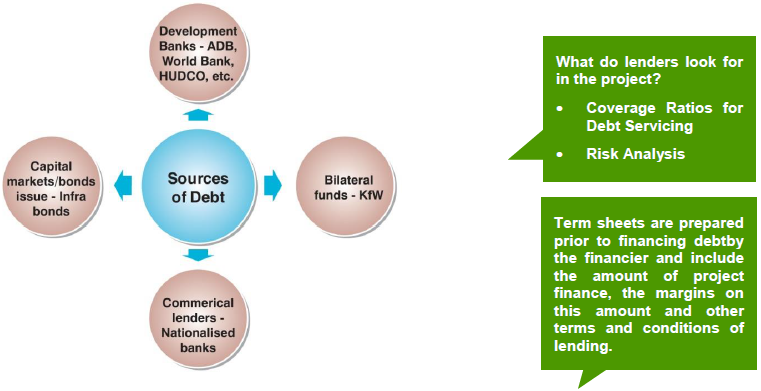

Debt

Debt is raised from banks, development partners and Government Agencies or the issue of bonds. Apart from these, subordinate debt and grants may also be sources of finance.

Lenders provide most of the debt as "senior debt". Since senior lenders do not have access to the sponsors' balance sheets in project financed transactions, they need to ensure that the project produces sufficient cash flow to service the debt. They also need to be given priority over the assets of the project before other creditors. Senior lenders may also seek additional credit support from the shareholders or the Government Agency. The riskier the project, the more the credit enhancements expected by the senior lenders. This is necessary to ensure that the debt can be repaid even in a conservative cash flow scenario.

Senior debt enjoys priority in terms of repayment overall other forms of financing. Mezzanine debt is subordinated to senior debt in terms of repayment but ranks above equity both for distributions of free cash in the so-called "cash waterfall" (i.e. priority of each cash inflow and outflow in a project) and on liquidation of the project special purpose vehicle.

Debt to a PPP project is priced normally on the basis of the underlying cost of funds to the lender plus a fixed component (or "margin") expressed as a number of basis points to cover default risk and lender's other costs.

| Debt to Equity Ratio Debt to equity ratio is the ratio between the quantum of debt to quantum of equity that is proposed to finance a project. Typically, a debt to equity ratio of 70/30 is assumed for projects. However, depending upon the risks involved in the project, the ratio may vary. Indicative debt to equity ratios that are assumed in projects are: • Hotels & Commercial Property: 50/50 • Industrial Project: 70/30 • Infrastructure and Power: 80/20 |

| Grant Based on financial feasibility of the project, the Government may provide support in the form of an upfront grant towards capital expenditure to improve its viability. |

|

| The Government of India provides capital grants as Financial Support (Viability Gap Funding Scheme) to PPP in Infrastructure across sectors; the same is more fully described in Module 12 sets out Pre-procurement Activities. |

|

| PROJECT | Tuni-Anakapalli Annuity Road Project The road expansion project was one of the several annuity projects under the Golden Quadrilateral programme, but stands out due to the innovative structure used for raising additional debt. Developed on a BOT-annuity model, the initial estimated project cost was Rs 315 crore which was funded with a debt-equity ratio of 3:1. The loan component had an average spread of 12-12.75 per cent with tenure of 13.5 years. The construction of the project commenced in May 2002 and was completed in December 2004. During the operational phase, the project company, GMR Tuni-Anakapalli. Expressways Private Limited raised additional debt of Rs 372 crores from a consortium of lenders through securitisation of future annuity payments which were to be received over a period of 15 years. Securitisation of future receivables allowed the private partner to raise these funds at a lower interest rate of about 3 per cent. These low-cost funds were used for prepayment of earlier project debt thus helping to save on outflows from revenue. Source: http://toolkit.pppinindia.com/ports/module3-rocs-taarp1.php?links=taarp1 |