3.3. Value Indicator

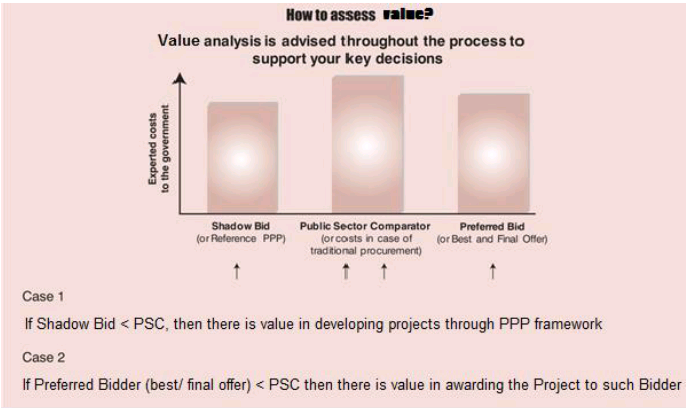

| The Value Proposition of projects analysis is determined by the value figure. This is the difference between the estimated cost of procuring the project through traditional procurement and the estimated cost of procuring private sector participation for any project. However, this provides just a single estimate under a particular set of assumptions. |

|

| Difference between Equity Internal Rate of Return (EIRR), Project Internal Rate of Return (PIRR) and Value figure • EIRR value shows the rate of return on investment that providers of equity capital would earn under the PPP. • PIRR value shows the rate of return on the total project cash flows for the projects being developed under PPP framework. • Value figure shows that the extent to which, based on a particular PIRR, the net present value of the option of developing the project under a PPP framework is better (if the figure is positive) or worse (if the figure is negative) than the net present value of developing the project on its own by the public entity. Source: Value for Money Assessment Guide, HM Treasury | |