4.3. Competitive Neutrality

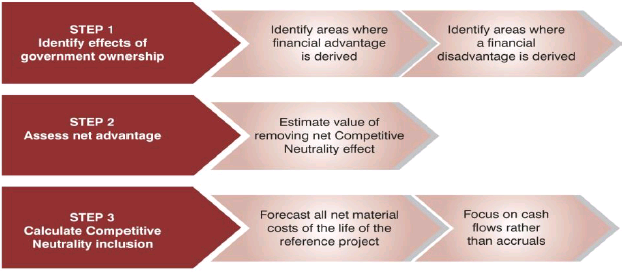

| Competitive Neutrality removes the net competitive advantages that would accrue to a Government business by virtue of its public sector ownership. The purpose of including this component is to allow a like-with-like value assessment between a PSC and private bids. |

|

Government-owned entities are engaged in many significant business activities and as a result there are distortions in resource allocation. Government business should not enjoy any competitive advantage simply as a result of their public sector ownership. Competitive advantages from public sector ownership typically include taxes that are not levied on public entities. Competitive disadvantages may also arise from public sector ownership and these are typically heightened public scrutiny and reporting requirements not faced by a private enterprise.

Competitive Neutrality inclusions in the PSC are made on a cash flow basis and the cost of capital is not included in the Competitive Neutrality component of the PSC numerator, but is reflected in the discount rate used to calculate the Net Present Value (NPV). Non-cash adjustments such as depreciation would not form part of Competitive Neutrality.