3. Elements of a PPP Structure

| The elements that constitute a good PPP project are usually derived from a set of fundamental aspects of the framework such as: 1. Does the PPP involve building new assets to provide the service (capital expenditure project) or are the services required for operations and maintenance only? 2. Which roles will the private partner carry out? For example, who will provide finance? Who will design and construct? 3. Who will take ownership of the assets? 4. If there are different private partners carrying out different functions, how will the relationship between the various parties affect the final project outcome? 5. What will be duration of the PPP contract? 6. How should the various risks be allocated between the private and public partners? 7. What will be the major revenue source for the project? For example, will it be from charges to users (direct tolls), or payment from Government (shadow toll or annuity)? 8. Is demand for the infrastructure service expected to be stable over the period of the contract? |

|

The elements of structuring are well demonstrated by the illustrative case given below:

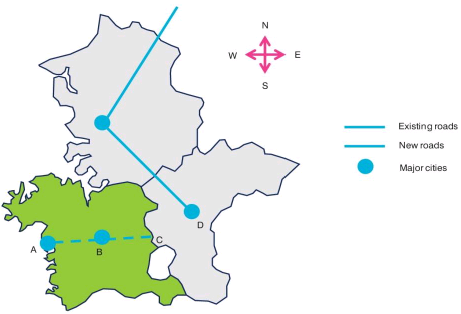

| A Government with limited fiscal resources but with a strong economic growth perspective wants to construct a new road from east to west to connect its port A via the capital city B to the border with the neighbouring State at C. The road is approximately 200 kilometres partly through a mountainous area east from the capital B. Demand east of the capital B is limited though expected to grow once the neighbouring State connects its capital city D to the border at C The construction costs amount up to INR 5,000 crore, mostly related to the required civil works in the mountainous area The key issues include: • The demand risk between B and C is quite significant as it will strongly depend on the construction of a road by the neighbouring State between C and D. It is fair to assume that the demand risk between A and B will be significantly less as it involves two main economic centres (a port and a capital) • The construction risk between B and C will also be quite significant as it will cross a mountainous area which will require the construction of tunnels and bridges which are commonly riskier than regular road infrastructure The considerations indicate the impact of risks on the mode of PPP and the scope of PPP. An integrated BOT from A to C is unlikely because of the high risk profile of the B to C section. Demand is uncertain and construction is very risky in view of the required civil works because of the terrain. By splitting the project, the attractiveness and achievability of a PPP from a private sector perspective increases. A BOT from A to B is more likely to be viable than a BOT from A to C. Then the question is to ascertain what the best way to connect B to C is? One may consider developing this in a conventional manner using Government resources; however the Government, in this example, is facing fiscal constraints. Given the high economic growth perspective, it is likely that the fiscal situation will improve in the future. Hence it may be more attractive to shift the fiscal burden to the future. This can be done via a BOT annuity where the private sector finances the construction and operates the infrastructure and the Government will repay the cost of the infrastructure over a period of time. However, the optimal solution in future may be different should the neighbouring State decide to construct the road from C to D and consequently traffic takes off between B and C. Then, the Government in the end may decide to introduce a public tolling system. If traffic takes off because of the construction of C-D the BOT concessionaire A-B will significantly benefit. And that benefit is not related to its own performance but from a decision of the neighbouring Government. It may be advisable to share that additional benefit between the concessionaire and the Government or between the concessionaire and the users by reducing the tariffs. Source: Knowledge Series, Training of Trainers Curriculum, PPP, Module II - Project Analysis and Structuring, Department of Economic Affairs, Ministry of Finance, Government of India |