2. What is Financial Close?

| Financial close occurs when all the project and financing agreements have been signed and all the required conditions mentioned in them have been met. It enables funds (debt, equity, grant etc.) to be available so that the implementation of the project may start with immediate effect. In simple words, financial close means that the funds for the project have been arranged. Financial Close includes a set of agreements being executed that are supported by various other legal documents (such as declarations, undertakings, etc.). |

|

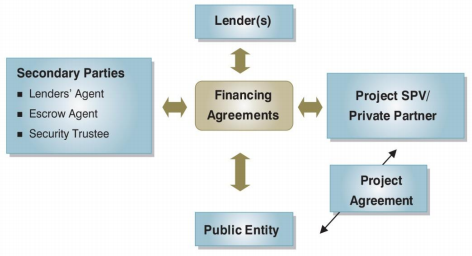

The diagram given below demonstrates the several arrangements between public entity, private partner and other entities that have a bearing on achieving the financial close.

The primary parties involved in the process of financial close are the public entity, the private partner and the lenders.

| From the perspective of the public entity, it is important to know whether the private partner has tied up all the funds required to undertake the project. Therefore, achievement of financial close by the private partner is considered as a condition precedent in the PPP arrangement. An excerpt from the MCA for development of National Highways on conditions precedent is set out as Annexure 15A of this module. MCA for development of National Highways also provides the following provisions relating to financial close with respect to the timeline for achievement of financial close, extension of time for achievement of financial close and remedy in the event of failure to achieve financial close. In addition to the above, the financial close is also linked to some of the key terms/conditions of the concession agreements such as: |

|

• Appointed Date/Commencement Date/Date of Award of Concession - For instance, the date of the start of the concession (in the case of a concession agreement), depends on the date of achievement of financial close and conditions precedent. This is a key date in the project timelines as the start period of a concession is mostly linked to this date.

• Total Project Cost (TPC) - The definition of the TPC may also be linked to the cost approved in the financial package or the financial close. This definition in turn is used to finalize the termination payments.

In many PPP arrangements, in the event of termination, the public entity may be liable to protect the lenders' interests to varying extent. In such cases, it is in the interest of the public entity to understand the quantum of debt financing that the private partner has availed off and the terms of such borrowing.

• From the private partner's perspective, achieving financial closure means that all the funds required for the project in terms of both equity and debt are tied up.

• From the lenders' perspective, they will commit their funds (debt) to the project only after the necessary due diligence has been completed. The promoter's ability to execute the agreement and fund the equity will also be assessed. Further, other conditions precedent, if any, to be fulfilled by the public entity and the private partner are also verified.

In addition to the primary parties, there are several other parties that are involved during the execution of the financing agreements depending on the nature of the project and the requirement of such services. The role of these parties begins only after the financing agreements have been executed and financial closure has been achieved. The secondary parties commonly involved and their roles are listed below.

1. Lenders' Agent: Lenders' Agent is a party who is identified to act on behalf of all the lenders to a project. Generally, a Lenders' Agent Agreement is executed between the Lenders which sets out the rights and duties of the Lenders' Agent.

2. Escrow Agent: The Escrow Agreement is executed between the concessionaire, the Authority, lenders and the escrow bank. This agreement generally provides for the role of the escrow bank as a trustee, its obligations, and the process to be followed for deposits and withdrawals from the escrow account of the project.

3. Security Trustee: A security trustee is identified through a Security Trustee Agreement that specifies the activities of the security trustee acting as the trustee for the lenders.