Country PPP Databases

3.3 Country-level databases are more helpful as they include all sectors. However, some of these databases, such as India's, are also a reflection of the institutional structure for approval of projects- which may mean that many small-scale PPP projects get excluded from these databases. The PPP databases of India, the UK, Australia, British Columbia, and others were examined where available and the following points give a brief summary of the trends.

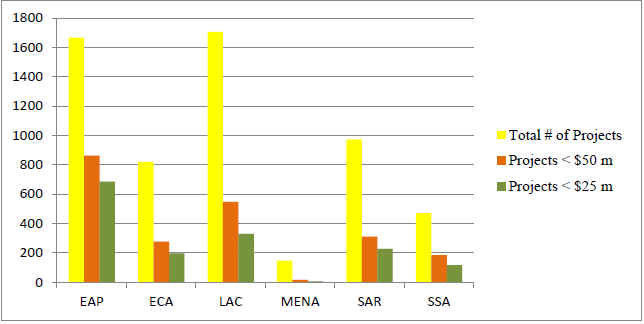

Figure 1: Small-scale PPP Projects by Region, Global

Source: PPI Database, World Bank

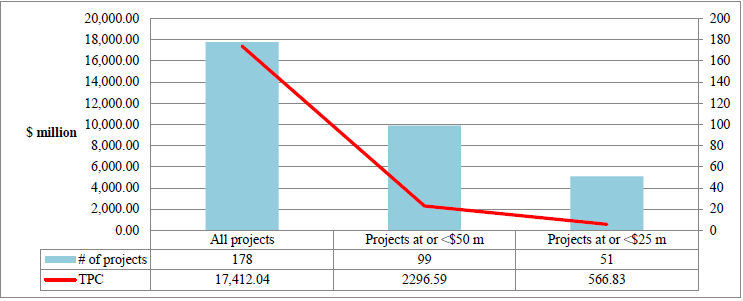

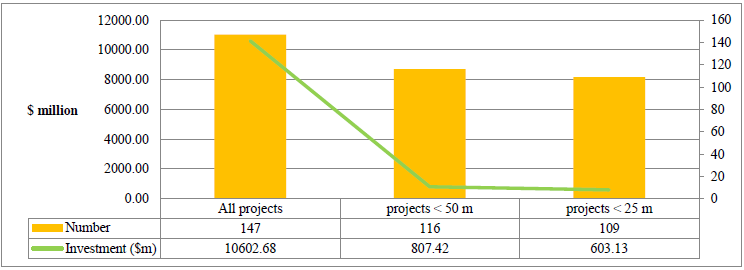

3.4 India has fewer small-scale projects at the national level given that national projects are mostly concentrated in national highways, major sea ports and airports and the energy sector. Some of the few national level small-scale projects in India are in the tourism, housing, and office space sectors. However, an examination of the Viability Gap Funding (VGF) database (see Figure 2) shows a larger number of small state and local level projects. A large number of small projects under the VGF4 relate to state highways and other smaller road projects, with 23 out of 178 projects being school and silo projects, developed and procured by sub-national agencies within the last couple of years. An examination of state and local body databases reveals that there are several small PPP projects, with the key sectors being solid waste, hospital diagnostics, rooftop solar, information and communications technology (ICT), small bridges, roads, tourism, and school education. Andhra Pradesh, a key PPP state in India has several such projects (Figure 3) with sectors as wide ranging as tourism (food courts, beach resorts, budget hotels, and water and sports facilities), urban amenities (shopping complexes, pay and use toilets, health care centers, service centers, multi-level parking, and abattoirs, i.e., slaughterhouses), and ICT projects. While state governments and municipalities in India have used a wide variety of PPP-like modalities to provide services in the past, in recent years there has been a more organized attempt to scale up these experiences and provide central government support to them.

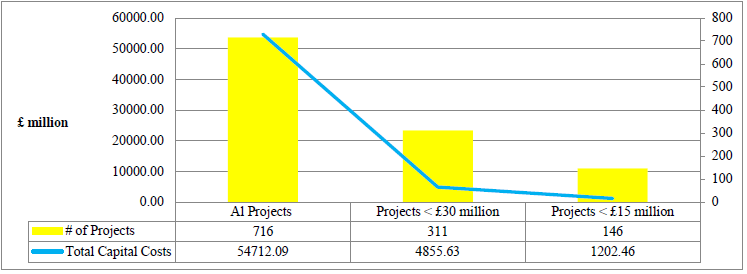

3.5 The UK PFI database shows several projects below £30 million and £15 million (Figure 4) in sectors such as education, waste management, street lighting and so on, including a large number of local body projects.

3.6 11 out of 58 projects in Kenya's pipeline of projects for which total project cost data is available and that have received first stage approval5 of the PPP Committee are $50 million or below in total project cost. These projects are in a surprising variety of sectors: health (oxygen plant, ICT services at the Kenyatta National Hospital, and a 300-bed private wing at Kenyatta National Hospital); university students' accommodation at Kenyatta and Moi Universities; parking (multi-level car parking in Mombasa); small transport (ferry services, ferry terminal, and O&M of road); and airport services (food court, in-flight catering kitchen). Only one of these projects is now in procurement. This particular project is dealt with in more detail in the next section and in the annex.

3.7 South Africa has small hospital and tourism PPP projects along with other very small municipal PPPs that lapsed some years ago. Several landfill, wastewater reuse, solid waste management, resort development, composting, fresh produce market, mixed-use property development, electricity distribution management, housing and shopping mall development PPP assessments are currently being conducted for municipalities all over the country. These have not reached closure yet.

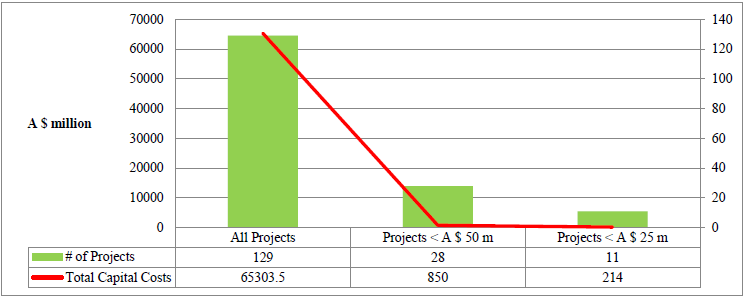

3.8 The Australia PPP database6 shows that 30% of all projects are $50 million or lower in total project cost (Figure 5), with the sectors being quite diverse: construction and maintenance of government buildings, water and waste water, industrial recycling, prisons, hospitals, and student accommodation among others.

Figure 2: VGF Projects by Size: Number and Total Project Cost (TPC). India. March 2014

Source: Department of Economic Affairs, Government of India

Figure 3: Approved Projects by Size, Andhra Pradesh, India

Source: Ministry of Finance, Government of Andhra Pradesh

Figure 4: UK PFI Projects by Size, March 2012

Source: HM Treasury PFI Database

Figure 5: PPP Projects in Australia by Size

Source: PPP Database, Australia

3.9 To get a better sense of how small projects are being structured, what institutional and policy issues characterize these small projects, and the constraints in financing and capacity, ten small-scale projects were examined. Of these, three projects are from Africa (Kenya, Lesotho, and South Africa); one is from the Middle East and North Africa region (West Bank and Gaza), and six are from India, which seems to have a high prevalence of small-scale projects. Key information on these projects has been captured in the Annex. Some broad features seen in these projects are summarized in Table 1 below. Similar to PPPs in general, there are essentially three overlapping types of small PPP projects:

• Projects based on availability payments that require more credit enhancement mechanisms to overcome the poor creditworthiness of local governments and the lack of capacity in local banks to assess such projects;

• Projects based on revenues from user charges, property development, etc., which require complex structuring;

• Projects based on donor support (in particular funding towards capital contributions, and upstream and mid-stream preparatory work) that overlap with the first two categories of projects.

The next few sections contain a more detailed analysis of the institutional and policy issues, and financing and capacity constraints observed in the projects examined.

Table 1: Basic Characteristics of Small Projects in Various Sectors

| Project | Sector | PPP Type | Value | User Charges/Government Support | Financing | Local/Foreign Investor | Distinct Approval Process |

| Kenyatta University Students Hostel | Accommodation | Estimated at $50 million | User charges, 80% occupancy guarantee by authority | Debt and equity | Local | No | |

| Palestine Solid Waste Project | Solid Waste Management | Operation and maintenance contract | - | Local body payment supported by GPOBA | Debt and equity | Foreign | No |

| Rural Integrated Infrastructure | $25 million | User charges on certain services, government subsidy of up to 30% | Debt and equity | Local | Yes | ||

| Gandhinagar Rooftop Solar | Non-conventional Energy | $9 million | Private Distribution Company buys entire power; government provides part of rooftop space | Debt and equity | Local | No | |

| Street Lighting Bhubaneswar | Urban Amenities | Performance based O&M contract | $4.8 million | Local body pays fee from energy savings | Equity | Local | No |

| Punjab Grain Silo | Agricultural Storage | $7 million | Fixed charges paid on guaranteed storage | Debt and equity | Local | No | |

| Berhampur Solid Waste | Solid Waste Management | $10.3 million | Output based payment by local body, grant and loan from OUIDF | Debt and equity | Local | No | |

| Upgrading Radiology Services | Health | $7 million | Government pays for referral patients, user charges for private non-referral patients | Debt and equity | Local | No | |

| Lesotho Health Care Waste Management | Health/Environment | Management contract | - | Government pays; lump sum fixed by bid | Debt and equity | Local and foreign | No |

| Cape Nature (De Hoop) Tourism Project, South Africa | Tourism | Concession | $4 million | Concessionaire pays lump sum to government, variable fee on top if demand exceeds a pre-agreed level | Equity | Local | No |

______________________________________________________________

4 The Scheme for Support to PPPs in Infrastructure also called the VGF Scheme was established in 2005 and has supported several projects, especially at sub-national levels. There are no total project cost caps or thresholds for VGF support in India, unlike in Indonesia where projects below $100 million are viewed to be not viable for support given high transaction costs.

5 There are three stages of approval followed in Kenya, the first approval being at concept stage.

6 All PPPs are by definition sub-national entities.