6 Recommendations for Further Work

6.1 Small PPPs are more common in non-traditional sectors. These sectors, as found in the earlier sections, are characterized by the lack of creation and dissemination of new knowledge, simple institutional structures and procedures, and standardization. This has made replication of these projects slow and painful, and it has also increased the time and cost of processing and has resulted in the lack of proper sequencing of activities. Another area with some scope of improvement is that of specific sector strategies for small municipal projects. Rather than being tackled project-by-project wherever the need arises, it may make sense to prepare specific sector strategies where these do not exist, for sectors like solid waste, parking, or accommodation; in the case of small road and bridge projects, strategy customized to smaller projects to help build a small-scale project pipeline. There is little upstream work available in countries, and there are few standard contracts in these sectors except in India in the grain storage sector where upstream policy has evolved over time and a standard contract is currently being reviewed as well for approval by the Planning Commission. There is also some work done in the solid waste sector across many countries, although rapid scaling up of projects has not been seen due to a plethora of associated reasons. The successes in some of these sectors are probably good for emulation in sectors with scope for quick scaling up.

6.2 The institutional structure for processing PPP projects from conception through development, appraisal, approval, and procurement stages is not suitable for small projects. Small projects with much lower capital costs require the same amount of time and similar complicated processes as for larger projects. In fact, given that most of the small projects tend to be subnational projects; several layers of additional approvals pertaining to line Ministry, local body and provincial government are required. Where the institutional structure for processing and approvals does discriminate based on size or other attributes, as in the case of India or South Africa, it is still not fully customized to the needs of small projects.

6.3 In terms of financing, there is a large market for commercial financing of small PPP projects below $50 million in some sectors, but most projects examined presented key structuring and credit enhancement requirements as well as related sector policy and institutional deficiencies that have the potential to deter financing of similar small projects on a larger scale. Small projects in some sectors are currently fully equity-financed due to there being no suitable lending products or due to a lack of capacity and information in banks to carry out due diligence. Current credit enhancement instruments are scattered or inaccessible to all sectors.

6.4 The capacity to carry out their specific roles in PPP development, financing, and implementation is sorely deficient in almost all the entities involved in small-scale PPP transactions. There is a preponderance of "just-in-case" training, but more focused process and activity related "just-in-time" training is largely unavailable.

6.5 There is a need for further work on two levels: immediate work focused specifically on small projects that will help in quick wins; and slower, and more embedded work in countries focused on the larger environment for small-scale PPP projects. The latter can most preferably be undertaken as part of the general work on strengthening the environment for PPP over the medium to the longer term in countries and therefore, is outside the scope of this review. Reforms to financial regulations and the strengthening of capital markets are among the longer term measures that need to be undertaken as a part of the general strengthening of infrastructure finance, with the requirements of small projects being kept in mind. In addition, institutional and financial strengthening of sub-national bodies-already a part of the work of several World Bank Group units-could be taken up with special focus on those countries and entities that present a scope for PPP implementation.

6.6 Areas where there could be quick results forthcoming with minor investments in effort and money can be initiated early. These areas are listed below:

Institutional and policy work targeting small projects: This includes upstream institutional and process level work to smooth out the different phases of small project implementation from conception through development, appraisal, approval, procurement, and contract management. This entails examining a separate framework for small-scale PPP projects and the creation of standard procurement and contract documents, and templates for other intermediate processes. This could be done through the preparation of separate regulations for small-scale PPP projects including these various components. In addition, it would be useful to look at having a repository of all small scale knowledge and capacity such as within the PPP unit in a Small PPP Cell or Sub-Unit. There are several such different mechanisms that can be explored. However, the break-up of the components that are recommended for development as a complete tool or standardized guidance for small projects is as follows:

• Fast track development and approvals process: This will include the development of simple institutional structures for developing, processing, approval and procurement of small-scale projects at sub-national levels.

• Fast track payments process: This entails looking in-depth at the processes in current small-scale PPP projects for making payments (availability, construction grant, other) and providing a streamlined process with minimum lags.

• Development of standard procurement and contract documentation: This will consist of the development of the following standard documents for key identified sectors: conception report / business case for first approval, detailed project appraisal documentation, contract documents, EoI/RFQ, RFP, performance reports, etc., based on lessons learned from initial cases to facilitate scaling up.

• Measuring and managing fiscal and contingent liabilities at municipal and aggregate levels: While many countries do not have a framework even for larger PPP projects, it would make sense to develop these procedures for managing risk of the small-scale PPP projects including standard frameworks, operating manuals and step-by-step how-to-do-it case studies to assist practitioners.

• Harmonizing upstream policy, differing policy regimes and tariff processes prevalent in different sub-national entities, especially in smaller local bodies where projects might have viability issues due to scale.

• Monitoring & Evaluation and contract management processes.

Sector analysis and reform targeted at sectors that feature small projects frequently: This would include country-level work exploring specifically identified emerging small sectors with regard to the current status of sector regulations, appropriateness or adequacy of the regulations for small PPP, identification of gaps, outlining / drafting modifications or new regulations, sector strategy, sector guidance and tariff policy, among other things. While these sectors would differ based on country and region, some frequently seen sectors are listed below. There is existing sector work in some of the sectors, as well as tacit knowledge that would need to be externalized and consolidated. Some sector prioritization may, however, be needed for sector analysis related work as PPPs are expanding to many sectors. There could be a focus on urban or semi-urban infrastructure services that could be more easily replicated when combined with a solution to credit worthiness issues.

• Urban amenities: multi-level parking, solid waste, medical waste, road, streetlight installation and maintenance, parks development and maintenance, health and education.

• Small roads within provinces

• Urban/ city roads

• Small bridges

• Abattoirs

• Tourism

• Accommodation

• Using urban spaces / rooftops for solar energy generation

Support for financing small-scale projects: This would include an examination of available government support mechanisms, the efficiency or otherwise of available frameworks and instruments to cater to small PPP projects, identification of gaps, designing modifications to available mechanisms and instruments, and exploring and outlining possible new mechanisms and instruments; including the examination of roles that multilateral development banks like the WBG can play in these. Some specific areas of work are listed below:

• Focused work on enabling more commercial bank financing of small projects: Given that small projects may not be amenable to project-by-project bond financing, and commercial bank financing may continue to be a key source of financing for small projects in the short to the medium term, it is clear that debt funding by banks needs to be increased and streamlined substantially over the immediate future. This can be done through innovative contract clauses to reduce credit risk, funds for support including credit enhancement (see below) and building capacity within commercial banks to understand small projects and their risk profiles.

• Exploring Bank Group guarantee instruments for small PPP projects: The norm has been for the Bank to provide guarantees in the case of larger more complex projects. However, small projects have largely remained out of this program. It may help to carry out a preliminary exploration of the pros and cons of Bank Group guarantees for smaller projects to see if this could be a feasible option for credit enhancement for small projects.

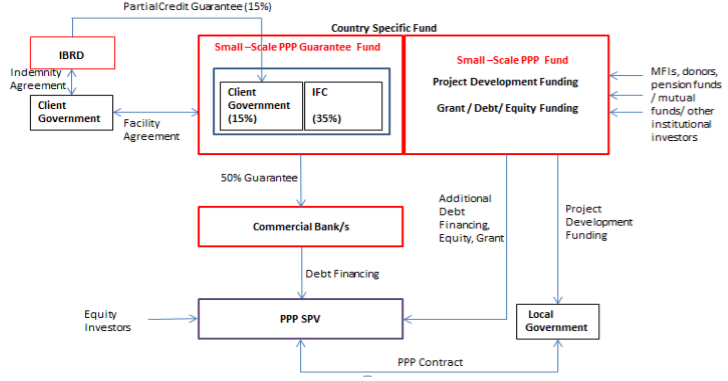

• Funding vehicle aimed at small sub-national projects: Rather than specific project level investments, the World Bank Group could initiate greater thinking around wholesale investing such as through urban infra funds or support vehicles with grant and non-grant products such as loans, guarantees, etc.; IFC or the World Bank can look at contributing to these funding vehicles within a practical and flexible framework in order to leverage private financing. The IDB concept on country specific SIFs could be one way to approach this. Another way to do this is through country specific guarantee / support facilities established exclusively for small-scale subnational PPP projects: the guarantee window can be backed by the client country / state government and IFC, with both together taking the first loss up to 50% or less (the proportion could be 15% client country and 35% IFC), with the client country portion backed up by a Partial Credit Guarantee (PCG) instrument of the World Bank. Further detailed design work is recommended to place the general design in context. However, apart from the guarantee instrument, windows for project development funding and other support instruments would be required. A multi-product small-scale PPP facility is a good option that may work for a variety of projects. A general schematic approach is suggested in Figure 6 below. However, this would need to be supplemented by both upstream sector and institutional work as suggested earlier in order to structure and bring good projects into the pipeline. In addition, it would help to look at funding innovative small projects through a "challenge fund" window in order to encourage promising new project structures that meet key benchmark criteria.

• Focused capital markets reforms: Analyzing markets for legal and regulatory constraints to financing of small-scale projects is another essential area that could help in creating further sources of long term financing for small projects. Specifically, impediments to lease financing and regulatory constraints to investments by institutional investors such as pension funds and insurance funds can be examined in depth in order to suggest focused limited reforms that can give quick results.

Figure 6: Schematic for a Multi-Product Financing Facility for Small-Scale PPP projects

Capacity enhancement: PPP processes are knowledge intensive activities and would need to be supported by smaller initiatives aimed at providing focused capacity enhancement related to specific projects being undertaken by the relevant entity and could include the following:

• Building skills in public entities to develop and appraise projects, initiate and manage the PPP procurement process, to monitor and evaluate and manage contracts; enhancing sector specific knowledge and skills

• Improving local private investors' understanding of PPP and sector issues

• Improving bankers' understanding of relevant sectors in small project and enhance small project related appraisal skills

• Building a knowledge base of case studies of successful small PPP projects with special focus on successful cases of bundling and how institutional, jurisdictional, and financing issues related to bundled projects have been successfully managed.