1.1.1. Sector trends

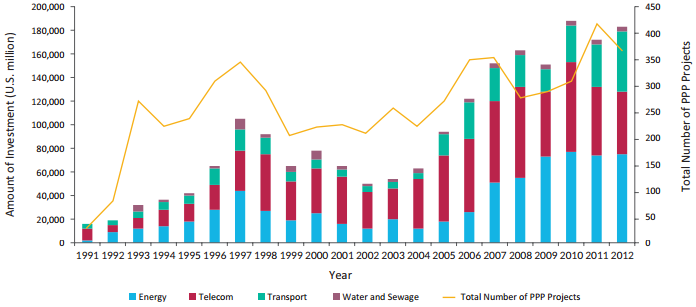

The energy sector attracted the largest amount of investments in 2012, with approximately US$76.8 billion and 244 projects (Figure 2). From 1990 to 2012, there were 111 countries with energy PPPs and 2,653 projects reaching financial closure.9 The most important segment was renewable energy, growing at an annual average of 21% since 2007 and doubling between 2007 and 2012.10 The Latin America and the Caribbean (LAC) region had the largest investment share (36%). In terms of the format of private participation, greenfield projects constituted 68% of total investments and 75% of all projects. A total of 126 projects were cancelled or under stress, representing approximately 5% of total investments between 1990 and 2012.

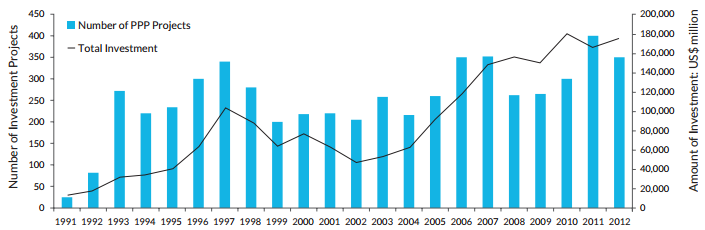

Figure 1. Global Trends for PPP Projects from 1991 to 2012

Source: World Bank and PPIAF, PPI Project Database

Figure 2. Sectoral Composition of Investments

Source: World Bank and PPIAF, PPI Project Database

The telecom sector was the second largest sector for PPPs in 2012, with investments totaling US$52.4 billion (15% lower than the US$60.2 billion in 2011. This is the lowest investment level since 2005. Only four PPP projects reached financial closure, the smallest number since the availability of the time series data. Of the different segments, 60% of investments went into stand-alone mobile operators.11 Compared with the energy sector, the telecom sector used predominantly greenfield projects, which constituted 61% of investments and 75% of the total number of projects. LAC was the most active region with 37% of total investments in telecom PPPs. The number of projects cancelled or under stress was approximately 3% of the total investments, representing 60 cases between 1990 and 2012.

Investments in the transport sector have been increasing over recent years, with a total of US$46.2 billion in 2012 spent on 83 projects, mainly in Brazil and India, which jointly constituted 78% of the investments made in 2012. Investment in this sector grew by approximately 25% between 2002 and 2012.12 Unlike the telecom and energy sectors, concessions were the predominant form of partnership, constituting 59% of the investments and projects. LAC is the most active region, with 42% of total investments. The number of projects cancelled or under stress was approximately 6% of the total investments, representing 78 cases between 1990 and 2012.

The water and sewage sector received the smallest amount of investment, with US$4 billion spent in 32 projects that reached financial closing in 2012. Despite the sector's small relative size, the total investments and number of projects rose noticeably over the past decade. In 2012, Brazil (11 projects) and China (14 projects) had the greatest number of water and sewerage projects.13 The predominant form of partnership was concession, constituting 62% of total investments and 41% of the overall project. Projects in this sector were heavily concentrated in East Asia and the Pacific, with 44% of the total investments occurring in these areas. The number of projects cancelled or under stress was approximately 30% of the total investment, representing 63 cases between 1990 and 2012.