The state-led economic model is not sustainable

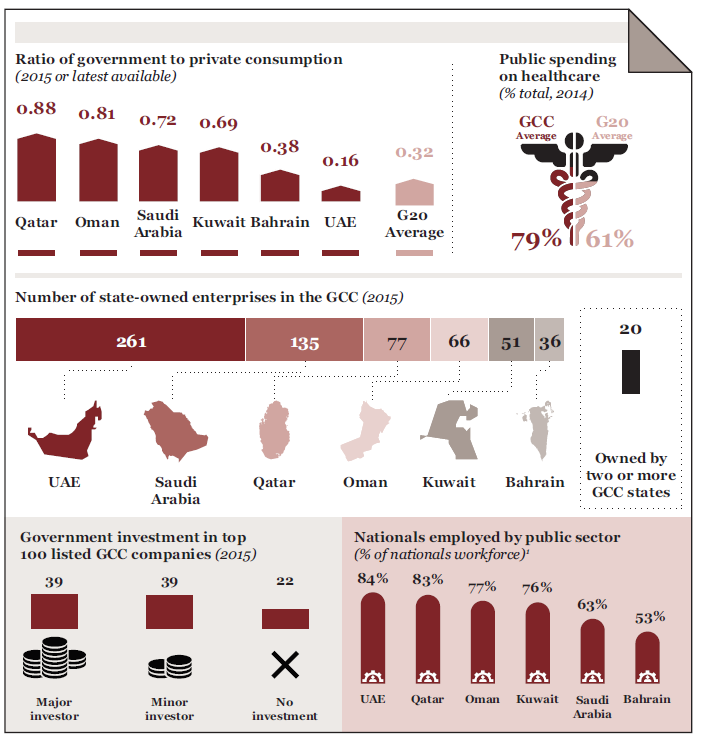

GCC governments are currently the dominant players in their economies (see Exhibit 1, page 7). A majority of the national workforces within the GCC states are employed by the public sector: more than 75 percent of nationals work in the public sectors in Kuwait, Oman, Qatar, and the United Arab Emirates (UAE), while the proportion in Saudi Arabia is 63 percent and in Bahrain, 53 percent. Collectively, GCC states hold stakes in 78 of the region's top 100 publicly listed companies and operate approximately 650 state-owned enterprises. GCC states also are the main providers of social services within their respective countries. For example, GCC governments account for nearly 80 percent of healthcare spending, compared to an average of 60 percent in the G20 countries.2

It has, however, become clear throughout the GCC that this state-led model is not sustainable. The immediate pressure is the price of oil, which remains significantly below the budgetary needs of GCC states. Additionally, there are a number of even greater long-term challenges to the sustainability of GCC economies:

• A high dependence on oil for government revenues and exports has impeded the development of a diversified economic base. Oil provides 73 percent of GCC governments' revenues and 82 percent of exports at a time when new technologies and environmental concerns are reducing the demand for fossil fuels.

• The limited participation of women and young people, and high levels of expatriates, have created unbalanced labor markets in the GCC. In Saudi Arabia, for example, one-quarter of citizens 15 to 29 years old are not in education, employment, or training (NEET), and 78 percent of women do not participate in the workforce. Moreover, 54 percent of Saudi Arabia's workforce is composed of expatriates.

• A growing need for infrastructure, healthcare, and education will increase budgetary needs at the same time that current revenue streams decline. The UAE, for example, will invest $300 billion in infrastructure by 2030; and Qatar will spend $205 billion to host the World Cup in 2022. Meanwhile, the GCC population growth is rising rapidly, which will require more spending on increasingly expensive education and healthcare services.

• The ecosystem for innovation, a key driver of national competitiveness, is insufficiently developed in the GCC. The UAE, Saudi Arabia, and Qatar are ranked 41, 49, and 50, respectively, in the Global Innovation Index, while Bahrain, Kuwait, and Oman are ranked 57, 67, and 73, respectively.3

Exhibit 1

Governments across the GCC dominate the economy

1 Data for nationals employed is available for Bahrain, Kuwait, and Saudi Arabia for 2013; Oman and Qatar for 2012; UAE for 2010.

Source: Sovereign Wealth Fund Institute; Alexandrina Maria Pauceanu, Entrepreneurship in the Gulf Cooperation Council: Guidelines for Starting and Managing Businesses, Academic Press, 2016; IMF; GCC countries' ministries of finance; Zawya; arabianbusiness.com; gulfbase.com; Gulf Labour Markets and Migration, European University Institute and Gulf Research Center; BQ magazine; Bahrain, Central Informatics Organization; Oman, National Center for Statistics and Information; UAE, Federal Competitiveness and Statistics Authority; The World Bank, World Development Indicators; The World Bank, World Bank national accounts data, and OECD National Accounts data fles; Strategy& analysis

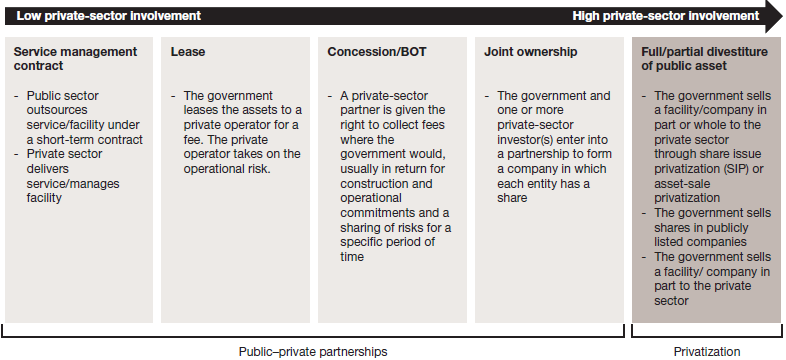

GCC states can address these challenges using two forms of PSP: the establishment of public-private partnerships (PPPs) and the privatization of government assets. PPPs involve various kinds of contractual arrangements through which a public entity and a private-sector partner can share skills, assets, and risks in the delivery of infrastructure, products, or services. Privatization involves the transfer of full or partial ownership of a property, product, or service - and its risks and benefits - to a privately owned entity (see Exhibit 2). The context will determine whether a PPP or privatization is preferable, with the optimal choice being determined by criteria such as readiness, risk, and the attractiveness of the opportunity to the private sector.

Indeed, the GCC states are already seeking to transform the basis of their economies with the help of PSP. In Saudi Arabia, Deputy Crown Prince Mohammed bin Salman has released Saudi Vision 2030, an ambitious plan that embraces public-private partnerships and privatization as a key element. It calls for the sale of a 5 percent stake in Saudi Aramco to investors, along with sales of stakes in state-owned enterprises in a variety of economic sectors, including utilities, transport, education, and healthcare.

Exhibit 2

Governments use two main forms of private-sector participation: PPPs and privatization

Source: The World Bank, "PPP Arrangements/Types of Public-Private Partnership Agreements," Public-Private-Partnership In Infrastructure Resource Center, July 13, 2016 (https://ppp.worldbank.org/public-private-partnership/agreements); Strategy& analysis