The benefits of greater PSP in the GCC

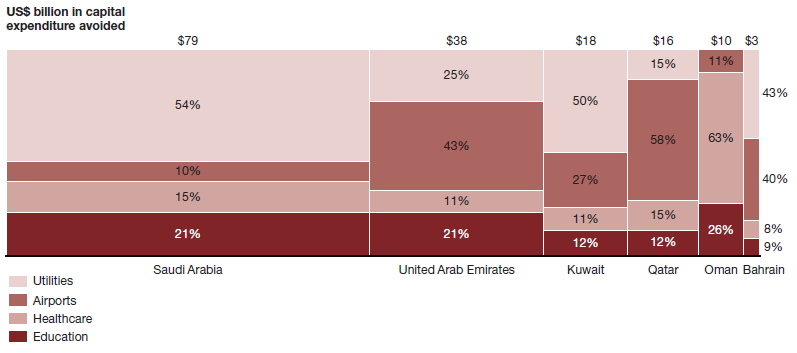

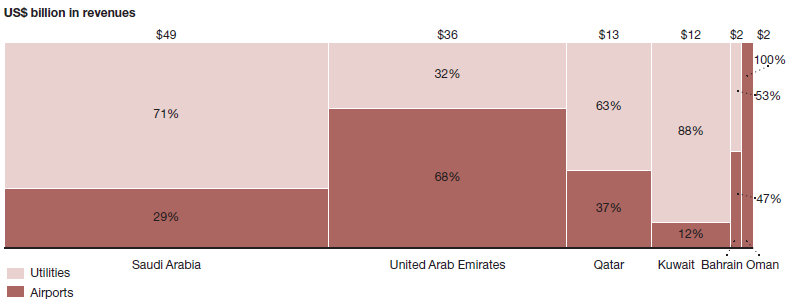

If GCC states embrace and bolster private-sector involvement in their economies, they could avoid $164 billion in capital expenditures by 2021 across utilities, airports, healthcare, and education alone. The largest portion of this capital expenditure avoidance, $117 billion, would accrue from the greater PSP in utilities and airports. In addition, the proceeds from the sale of public assets could generate sizable revenues, which can be reinvested in activities that support economic growth, such as education and innovation. For instance, sales of government utility and airport assets alone could generate $114 billion in revenue, and sales of government shares in publicly listed companies across sectors offer up to $287 billion in revenue (see Exhibits 3 to 5). Additionally, operational efficiencies of 10 to 20 percent can be achieved through PSP. This would help reduce government budget deficits.

Greater PSP offers other longer-term benefits to the GCC states. Well-structured PSP projects would attract interest from international investors around the world, thus promoting foreign direct investment. The sale of public assets through share-issue privatization and the reduction of government ownership in currently listed assets would spur the broadening and deepening of GCC capital markets.

With greater PSP, GCC states can begin to reshape their labor markets to look more like those of developed markets such as the U.K. and the U.S., where 80 percent of the workforce is employed in the private sector, compared to only 20 percent that is state-employed. Furthermore, the creation of new private-sector jobs would provide much-needed employment opportunities for women and the young generation.

Greater private-sector involvement in the GCC could help improve the delivery and reach of services - including education, healthcare, transportation, and utilities - as well as benefits in the construction and management of infrastructure.

Exhibit 3

With PSP, GCC states could avoid $164 billion in capital expenditure across four sectors by 2021

Source: MEED database; government budget reports; Strategy& analysis

Exhibit 4

Privatization of utilities and airports alone could raise $114 billion

Source: MEED database; Strategy& analysis

Exhibit 5

Government shares in publicly listed companies could raise $287 billion

|

| Financial Services | Oil and Gas | Telecoms | Mining and Mineral | Other | Total in US$ billion | Total number of companies |

| Saudi Arabia | 31.6 | 54.5 | 26.4 | 7.9 | 8.2 | $128.6 | 46 |

| United Arab Emirates | 32.3 | - | 31.3 | - | 21.1 | $84.7 | 53 |

| Qatar | 25.6 | 6.0 | 5.9 | 11.4 | 4.4 | $53.3 | 34 |

| Kuwait | 7.8 | 0.2 | 1.6 | - | 1.7 | $11.3 | 57 |

| Bahrain | 2.1 | - | 0.7 | 0.8 | 0.4 | $4.0 | 18 |

| Oman | 2.0 | 0.2 | 1.4 | - | 1.0 | $4.6 | 58 |

| Total | $101.4 | $60.9 | $67.3 | $20.1 | $36.8 | $286.5 | 266 |

Note: Figures as of October 2016. Saudi Electricity Company and Qatar Electricity and Water Company were excluded from this assessment.

Source: Zawya database; Strategy& analysis

Greater PSP could also help GCC states close their innovation gap with other countries. Between 2013 and 2015, fully 70 percent of global innovations stemmed from the private sector, versus 13 percent from the nonprofit sector and only 8 percent from the public sector. Within the private sector, small and medium-sized enterprises were responsible for over 65 percent of global innovations. A more robust private sector in the GCC would play a role in broader efforts to foster innovation in the region.

In summary, PSP would enable the GCC states to refocus their efforts on the essential tasks of government, which means becoming more "fit for service" (defined as becoming more cost-effective and better equipped to meet constituents' needs in the process).4 They could focus on fewer and more important tasks - bringing more effort and resources to bear on the achievement of critical goals. Instead of being the leading provider of services and employer of people, for example, government entities could refocus on their roles as facilitators and regulators.