Institutional setup for privatization

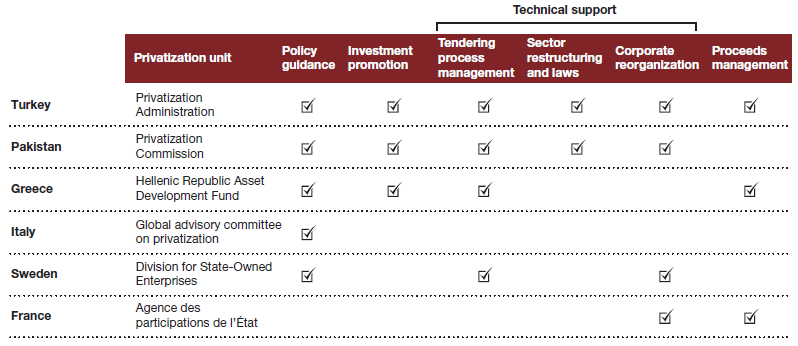

The function of privatization units includes opportunity identification, the management of the tendering process, investment promotion, proceeds management, corporate reorganization, sector restructuring, and laws. The roles of such a unit depend on several factors, including the size of the privatization agenda, the functions required to achieve it, and existing capacity within government (see Exhibit 10).

As with PPP units, the governance models of privatization units also will vary with the role and scope of their work. If privatization units are centralized, they can be placed at the center of government or under a committee of ministers. If they are part of economic change agenda, they can be attached to the economic or finance ministry. If they are part of an asset divestment program, they can report to the state ownership agency.

The key success factors in privatization unit design are also similar to those of PPP units. They require the sponsorship and commitment of senior leadership, and location within a powerful entity. They need to coordinate their activities with the rest of the government and with the private sector (usually through an advisory board). They also require a high-caliber staff with technical expertise.

The institutional setup for privatization includes the additional possibility of mass investment via investment funds. There are three generic models for investment privatization funds (IPFs): a free market model, a restricted market model, and a regulated market model. In the free market model, the establishment of funds is left to market forces, and the role of the state is limited to stipulating the establishment procedure. IPFs accumulate their voucher capital from individual voucher holders, who can invest their vouchers directly in privatized companies or use them to acquire shares in IPFs. In the restricted market model, voucher holders cannot invest their vouchers directly in privatized enterprises and must choose instead among the existing IPFs. In the regulated market model, IPFs are founded by the state, but privatized in the process of issuing shares to the public in return for vouchers. Again, voucher holders may invest in IPFs only, not directly in enterprise assets.

By enlarging the pool of potential investors, IPFs and vouchers can help accelerate the progress of privatization projects. A broader distribution of investment opportunities also can help programs achieve equity and fairness targets, and diffuse investment risks.

Exhibit 10

The roles of privatization units vary by the needs and capacity of the government

Source: Strategy& analysis