4.3 Affermage or Lease Contracts

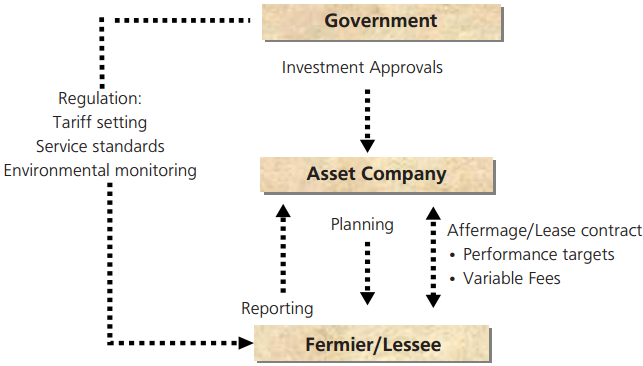

Under a lease contract, the private partner is responsible for the service in its entirety and undertakes obligations relating to quality and service standards. Except for new and replacement investments, which remain the responsibility of the public authority, the operator provides the service at his expense and risk. The duration of the leasing contract is typically for 10 years and may be renewed for up to 20 years. Responsibility for service provision is transferred from the public sector to the private sector and the financial risk for operation and maintenance is borne entirely by the private sector operator. In particular, the operator is responsible for losses and for unpaid consumers' debts. Leases do not involve any sale of assets to the private sector. Figure 6 shows the lease contract's typical structure.

Figure 6: Structure of Lease Contract

Source: Heather Skilling and Kathleen Booth. 2007.

Under this arrangement, the initial establishment of the system is financed by the public authority and contracted to a private company for operation and maintenance. Part of the tariff is transferred to the public authority to service loans raised to finance extensions of the system. See Box 5 on leasing in the ports sector.

An affermage is similar, but not identical, to a lease contract. Unlike a lease where the private sector retains revenue collected from customers and makes a specified lease payment to the contracting authority, an affermage allows the private sector to collect revenue from the customers, pays the contracting authority an affermage fee, and retains the remaining revenue. The affermage can be more appealing to the private partner as it reduces some risks associated with low-cost recovery in sales. The affermage fee is typically an agreed rate per every unit sold.

Box 5: Leasing in the Ports Sector |

In Asia, lease contracts are usually used in operating airport terminals or seaport container terminals. Both India and Thailand have ongoing lease contracts to operate container terminals at the seaports of Bangkok and Cochin, Karala State. The Indian contract is for 8 years and involves private participation from the United Arab Emirates. The Thai contract involves local companies and is to run for 27 years. In the People's Republic of China, the Guangzhou Baiyun Airport Terminal is operated under a lease contract with the Keppel Group of Singapore which has a 15-year contract and 25% ownership of the project company. |

Source: World Bank. 2006. Private Participation in Infrastructure database. |