4.6 Joint Venture

Joint ventures are alternatives to full privatization in which the infrastructure is co-owned and operated by the public sector and private operators. Under a joint venture, the public and private sector partners can either form a new company or assume joint ownership of an existing company through a sale of shares to one or several private investors. The company may also be listed on the stock exchange. A key requirement of this structure is good corporate governance, in particular the ability of the company to maintain independence from the government. This is important because the government is both part owner and regulator, and officials may be tempted to meddle in the company's business to achieve political goals. From its position as shareholder, however, the government has an interest in the profitability and sustainability of the company and can work to smooth political hurdles. The private partner assumes the operational role and a board of directors generally reflects the shareholding composition or expert representation. Box 9 highlights joint venture arrangements in the PRC.

Box 9: Energy Expansion through Joint Ventures in the People's Republic of China |

General Electric (GE) Energy has been active in the People's Republic of China (PRC) for more than 90 years, supplying 70 steam turbines, 165 gas turbines, 97 wind turbines, 180 hydropower units, and 300 compressors as well as total engineering solutions to help the country improve the reliability and availability of its energy production and transmission equipment. GE Liming is an $18.9-million joint venture formed on 28 August 2003 between GE Energy (51%) and Shenyang Liming Aero-Engine Company, Ltd. (49%), one of the PRC's primary manufacturers of aero-derivative gas turbines and jet engines. The joint venture manufactures combustion components, buckets, and nozzles to contribute to the assembly of GE's Frame 9FA and 9E gas turbines in the PRC. GESTT, a $13.7 million joint venture, was formed on 8 January 2003 between GE Energy (75%) and Shenyang Blower Works (SBW) (25%), a major state-owned enterprise in centrifugal compressors, blowers, and gear manufacturing in the PRC. The joint venture brings to the Chinese oil and gas industry a wide range of GE Energy's oil and gas service offerings, coupled with strong local capability. |

Source: GE Energy. 2005. GE Energy Expands Role in China. 25 August. Available: www.gepower.com/about/press/en/2005_press/082505.htm |

The joint venture structure is often accompanied by additional contracts (concessions or performance agreements) that specify the expectations of the company. Joint ventures also take some time to develop and allow the public and private partners considerable opportunity for dialogue and cooperation before the project is implemented.

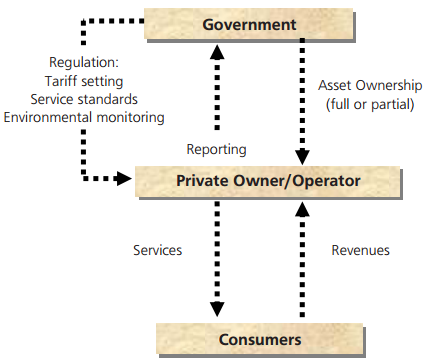

Under the joint venture structure, both public and private partners have to be willing to invest in the company and share certain risks. Figure 9 is the typical joint venture contract's structure.

Figure 9: Structure of Joint Venture Contract

Source: Heather Skilling and Kathleen Booth. 2007.