Why now?

The current interest in PPPs in Saudi Arabia has been predominantly driven by the decline in government revenue due to lower oil prices. With less government financing now available, PPPs provide a great opportunity to tap into private sector finance to fund major projects, allowing the government to redirect its finances towards priority sectors and reduce the fiscal budget.

A secondary attraction of PPPs is that they provide access to specialist expertise and experience to deliver higher quality services (such as transport, housing, healthcare and education), in a more timely and efficient manner.

The Saudi Vision 2030 (the Vision) announced in April 2016 aims to increase the private sector contribution from 40% to 65% of GDP. Given the growing demand and current shortages in key sectors of the economy such as housing, education and healthcare, it is not surprising that the government has turned to PPPs to increase the private sector's role and involvement.

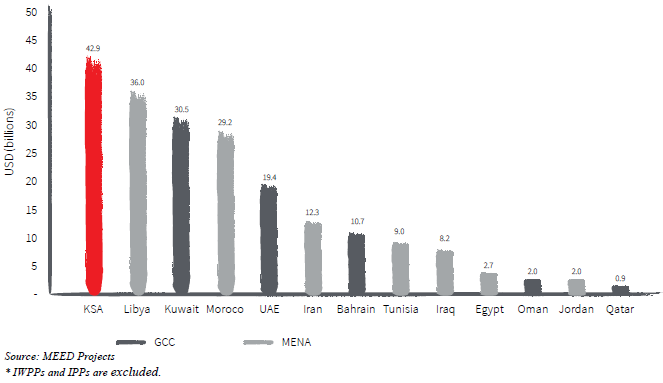

Value of PPP Projects by Country (September 2017)

According to MEED Projects, Saudi has the highest value of PPPs in the region, A total of 18 projects have been announced to date, with a combined investment of almost USD 42.9 billion (Saudi accounts for around 21% of the value of PPPs in the MENA region). The extent of the economic imperative and the strong political will make this an opportune time to consider PPPs in the Kingdom.