PPPs in Saudi

While private sector contribution to publicly funded projects is not new within Saudi, it has traditionally been largely restricted to the energy and transport sectors. This theme is consistent across the region, with many of the earlier examples of PPPs relating to transport infrastructure, include the Cairo metro extension and Suez Canal in Egypt, Queen Alia Airport expansion in Jordan, and the Tangier-Marrakech Railway and Casablanca Port expansion in Morocco.

The first true PPP project in Saudi Arabia was the financing, development and operation of Prince Mohammad bin Abdulaziz Airport (PMAA) expansion in Madinah, which was signed in 2011. This project demonstrates that a successful PPP can be undertaken in Saudi, despite the absence of a clear legal framework. The key aspects of this agreement between the General Authority for Civil Aviation (GACA) and a consortium comprising of TAV Airports, Al Rajhi and Saudi Oger are summarised in the table below:

Model used | Build-operate-transfer (BOT) |

Contract parties | GACA and private consortium of TAV Airports, Al Rajhi and Saudi Oger |

Coverage | The financing, development and operation of the PMAA expansion project |

Contract length | 25years |

Budget | SAR 4.5 billion (USD 1.2 billion) |

Notable dates | 2011 agreement signed 2012 financial close 2015 operations began |

Financers | National Commercial Bank (NCB) Arab National Bank (ANB) Saudi British Bank (SABB) |

Achievements | First commercial airport in the MENA region to receive a Leadership in Energy and Environmental Design Gold Certification. First large-scale project entirely financed through Islamic finance using a PPP model. Increased airport capacity from 5 million to 8 million (60%) per annum. |

Source: MEED Projects, JLL

The successful completion of the PMAA project set a precedent and acted as a guide for prospective investors, resulting in the announcement of a further five PPP projects in the airport sector.

• Ta'if International Airport,

• Prince Abdul Mohsin bin Abdulaziz Airport in Yanbu,

• Prince Nayef bin Abdulaziz Regional Airport in Qassim,

• Ha'il Regional Airport,

• King Khalid International Airport (Terminal 6) in Riyadh.

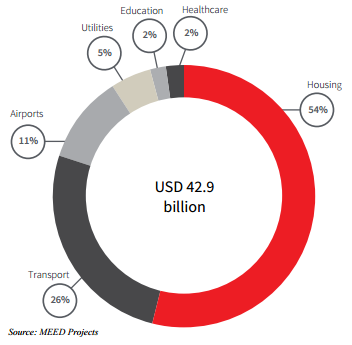

These projects, which are at various stages of tender, have a combined value of SAR 17.6 billion (USD 4.7 billion), resulting in airports accounting for 11% of the total value of PPPs in Saudi. King Abdulaziz International Airport in Jeddah, due to begin operations in 2018, will also be privately operated by Changi Airports International for a period of 20 years.

The PPP model used in each of these airports is very similar, which can restrict the flexibility of arrangements and the roles of the public and private parties in a particular sector.

Three of the five additional airport related PPPs were signed between GACA and the same consortium (Al Rajhi and TAV Airports), highlighting the first mover advantages in the PPP field. Particularly in a non-transparent market, early participation can develop relationships with government agencies as well as the practical skills and knowledge to position private sector consortiums as frontrunners for future PPPs.

The housing sector currently accounts for 54% of the value of PPPs in the Kingdom. This reflects the severe shortage of affordable housing and the recognised need for private sector financing and delivery skills to address this shortfall.

While the education and healthcare sectors each currently account for only 2% of the PPP market, this is expected to increase rapidly over the next 5 years following the announcement by the Saudi Arabian General Investment Authority (SAGIA) to privatise parts of these markets that have traditionally been funded and operated by the public sector within Saudi.

PPP Sector Value Breakdown (September 2017)