1.4 ROLES OF THE PUBLIC AND PRIVATE SECTORS IN PPP PROJECTS

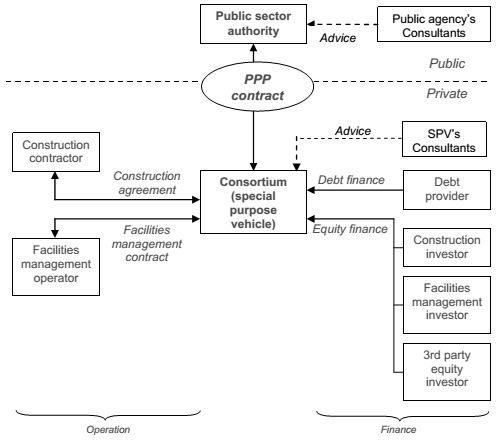

1.4.1 A PPP project involves collaboration between various types of private sector companies and the public agency. The PPP deal should be structured to be mutually beneficial to all the parties involved, with each party taking on the responsibilities which it is best able to manage. The roles of the public sector and the various private sector parties (including construction companies, operations companies, financial institutions and PPP consultants/advisors) in a typical PPP project under the Design-Build-Finance-Operate model are shown in Figure 1.2.

Figure 1.2 Typical PPP (for DBFO model) project structure

1.4.2 In general, the roles and responsibilities of the various parties collaborating in a PPP project are as follows:

a) Public agency - Purchaser of services. As the purchaser of services, the public agency will specify the outcomes/outputs that it requires and avoid specifying the means of the delivering the services. The public agency will also pay the PPP provider when the services are delivered according to the contract performance standards.

b) Design, Construction, Operations and Maintenance companies - Service providers. These private companies will form the Special Purpose Vehicle (SPV) to bid for the PPP project. These companies play the critical role of proposing innovative solutions to meet Government's objectives for the PPP project. In a typical PPP project, the SPV will manage its design, construction and operational and maintenance responsibilities, by subcontracting the construction, operations and equipment supply to suitable providers. These subcontractors may be the parent companies of the SPV (i.e. the construction, operations and maintenance companies which are the equity investors of the SPV). In addition, the SPV will also raise the financing it needs to build any asset it requires to deliver the services. It will need to explore the financing arrangements, such as the quantum of the debt/equity, the rates of returns required and the tenure of loan, with potential equity and debt providers. When the SPV starts to deliver the services, it will use the service payment streams it receives from the procuring agency or any third party revenue generated to repay its debt and equity providers, as well as its suppliers and subcontractors.

c) Equity investors and Debt providers- Private financiers. The equity investors of the SPV are typically the construction and operations companies who will be involved in the actual service delivery. Fund managers or other financial institutions may also take equity stakes in the SPV. Equity investors are interested in generating positive returns on their investment, and hence have a strong interest in ensuring that the services delivered meets the performance standards that were agreed between the public agency and the SPV. Debt providers, such as banks and bond holders, usually provide the majority of the funding (sometimes up to 80% - 90%)The debt providers will carry out due diligence on the SPV (such as its technical capability and financial soundness to be able to deliver on the PPP contract) and scrutinise its business plan to ensure that its plans are robust.

d) Consultants (if necessary) - Advisors. The public agency and the private sector bidder may also separately decide to engage consultants (such as technical, legal and financial consultants) to help them structure a PPP tender, and to work out a viable PPP proposal respectively. Advisors who have experience in developing PPP contracts can help to highlight the best practices to adopt or the pitfalls to avoid when preparing for a PPP deal.

e) Ministry of Finance - PPP Policy Owners. The role of MOF is in the formulation of PPP policies and guidelines, taking into due account the feedback from private sector players and public agencies, as well as the PPP experience of overseas governments. At the same time, MOF is raising awareness amongst public agencies to level up knowledge of PPP and build capability within the public sector. MOF also engages agencies early and works closely with them on specific projects. In particular, the Centre for Public Project Management (CP2M), set up in 2010, will also build up PPP expertise in order to assist agencies in the design and management of PPP contracts. MOF desk officers will continue to be responsible for evaluating the DPC proposals.