2.1 Nature of Public-Private Partnership

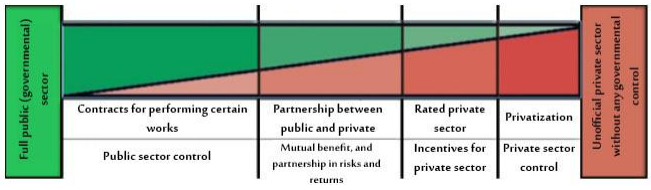

The PPP contracts shall be on long-term basis, and aim at providing public services and establishing infrastructures through utilizing the private sector's efficiency, financial potentials and expertise. It is not a capital-based partnership nor a profits-based partnership, but a partnership in risk sharing, where the public sector transfers some of project risks to the private sector and retains others. The privatization involves transferring all project risks to the private sector, where the State's role is limited to regulate and monitor implementation; while the private sector partner (the project company) bears both profit and loss risks. In the case of management or management and operation contracts then the State's retain all the risks, while the private sector's role is limited to providing a certain service in return for charges with some incentives. However, the PPP shall include all kinds of risk-based partnership according to ratios varying from project to another. For example, in partnership contracts, the private sector shall bear the risks of development, design, construction and operation, exploration, finance and inflation, whereas the public sector shall bear the environment, regulation, policy and tariff risks. Both parties may bear the risks relating to force majeure, supply and demand, personnel relations, profit and loss, technological development, etc.

The second element that distinguishes partnership from traditional procurement deals or simple outsourcing contracts is identification of outputs rather than inputs, i.e. the State does not buy (or build at its own expense) the assets required for providing the public service as is the case in traditional outsourcing, but instead it shall buy the output service. For example, the State shall not buy (or build at its own expense) a power plant, instead it shall buy electricity that meets its needs to provide the service to the citizen.

The graph below illustrate the relation between public sector and private sector :