3.6 PPP projects are delivering long-term VFM outcomes

Finding 6 PPP facilities maintain value for money over the long term. There was no evidence of price creep or risk transfer back to the public sector during the operational phase of the case study projects. |

Value-for-money (VFM) during the operational phase was assessed via project documentation and commentary from interviewees familiar with the commercial status of the PPP facilities. There was strong evidence that the contracts were being administered in line with the agreements struck and no evidence of risk transfer back to government. There were many examples of abatements being applied if the required service standard was not met or met in a timely fashion.

The research explicitly focused on VFM over the long term, to fill a gap in current literature. While reviews by the various Treasuries, as well as Auditor General reports and independent research reports, have established that the VFM test was achieved at the time the contracts were let and then to the conclusion of the construction phase, it was assumed, rather than confirmed, that VFM was maintained over time.

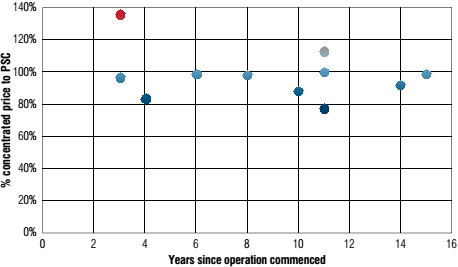

Figure 5 plots current value for money for the case study projects against the number of years in operation. All projects have maintained their value over time relative to the Public Sector Comparator (PSC), with oldest operating project spanning a period of 15 years. There is no evidence of attempted price gouging by the private sector over the operational phase or transfer risk back to the public sector. The alignment of private and public incentives achieved during contract negotiation have held over the long term.

Figure 5: VFM achieved for the case study projects over time

While service providers do not have visibility of the costs for the services being provided, their general impression is that VFM has been maintained during their involvement with the PPP project. They acknowledged that the price of the PPP contract was matched by its high level of service, and they felt this price was appropriate and welcomed. There was one example where general departmental practices had been enhanced to mirror the PPP level of services, and in this case, costs were reported to be similar to that of PPP projects.

Although evaluating the impact of innovation on VFM outcomes was not part of this research project, its importance was evident during the research workshops. Innovation was observed by the authors as one of the VFM factors that was indirectly discussed by service providers. Service providers gave examples of excellent design in facility layout, or new facilities management techniques, which they believed added value to the facility. If innovation is part of the government's project brief, then it is crucial to measure core service performance changes due to innovation in operational phase. Given the key role of innovation in PPP projects, the authors believe SPVs should continue to communicate to all stakeholders the value derived from innovation during operational phase.