B.3.2 Performances and debates

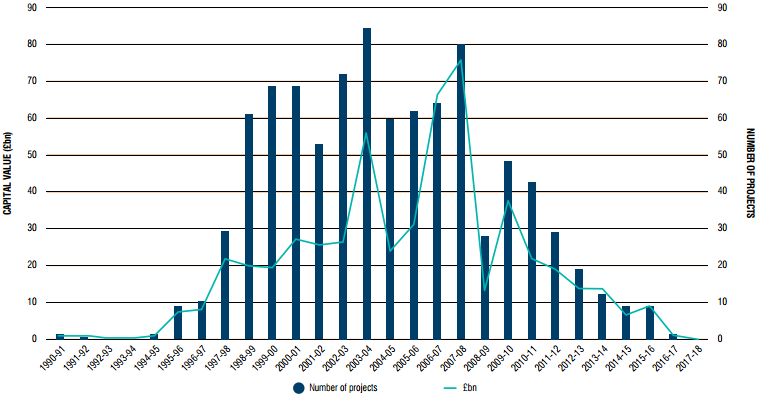

Figure B.2 shows UK PPP contracts from 1990 to 2014. Under a typical PFI deal, the public sector enters into a long-term contractual agreement with private sector companies, which undertake to design, build, operate and maintain an asset. Currently, in the UK there are around 700 operational PFI and PF2 contracts with a capital value of around £60 billion (House of Commons Committee of Public Accounts, 2018). Annual charges for these deals amounted to £10.3 billion in 2016-17. Even if no new PPP contracts are entered into, existing contract costs will continue until the 2040s, by which time will amount to £199 billion (HM Treasury, 2017).32

Figure B.2: UK PPP contracts 1992-201533

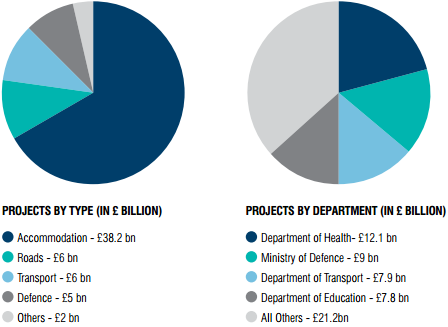

Figure B.2 provides a good representation of how in recent years, the UK Government's use of the PFI and PF2 models has slowed significantly, reducing from an average of 55 contracts executed each year in the five years to 2007-2008 to only one in the financial year of 2016-17.34 The use of current PFI model was cancelled in 2018 by the UK Government (House of Commons Committee of Public Accounts, 2018). Figure B.3 represents PFI usage in different UK Government departments.

Figure B.3: Use of Private Finance by project and department type35

HM Treasury has noted that the higher cost of private financing means that the economic case for the model rests on achieving cost savings in the construction or operation of the project. The UK Government is open to exploring the use of private finance for government funded projects to achieve potential benefits of risk management, innovation and project discipline (HM Treasury, 2019).

The UK Parliament's Treasury Select Committee and Public Accounts Committee, and the UK government's National Audit Office, have corroborated in a study (HM Treasury, 2012) and have established that some PPPs have failed to deliver VFM outcomes, and have created outcomes heavily skewed in favour of private interests. Despite some highly negative observation of facts regarding the domestic utilisation of PPPs, the UK government has played an active role in widening the use of PPPs to developing countries. For example, the UK government has set up and funds the Private Infrastructure Development Group (PIDG) which exists to promote PPPs to finance infrastructure in developing countries. Between 2002 and 2013, the UK's Department for International Development disbursed £663 million from its aid budget to PIDG, covering two- thirds of the contributions by all donors.