Analysis of project documentation

An analysis of project documentation listed in Section C.2 was undertaken. And given there was no evidence of price adjustments for contracted services or for changes to the allocated risks in the executed contracts, it was considered reasonable to rely upon the original assessments of VFM regarding the tender accepted by government. This assumption was tested during interviews with key staff.

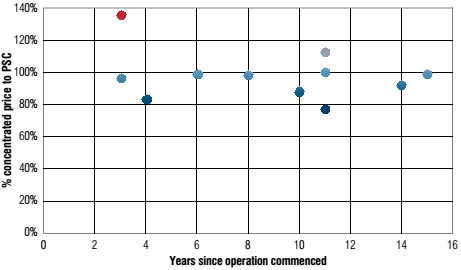

Based on official government records, the VFM achieved is often expressed as a ratio of the contracted price of the PPP project compared to governments estimate of what it would cost to provide the service, known as a Public Sector Comparator. To test value over time a number of comparisons have been made.

Figure D.5 details the ratio of the contracted price of the PPP project compared to the PSC over time for the 12 case study projects. Some important observations from this figure are that: only two projects exceeded governments estimate - in all cases government had strong bids from a competitive market so it can only be assumed that the market price was the right price for the service outcomes specified. The one project that exceeded the PSC by some margin also achieved a very high satisfaction rating. Overall, it appears that the PPP market has operated consistently over the last 15 years with value being achieved. There is no indication of price creep over time. It is concluded that the PPP market is functioning as a mature market.

Figure D.5: VFM (ratio of contracted price to original PSC) over time