OVERVIEW

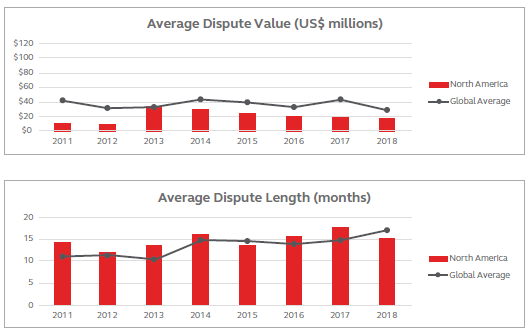

The value of disputes in North America continued to drop in 2018, making it the fifth consecutive year the value of disputes dropped since a peak in 2013. However, the average time taken to resolve disputes in the region decreased slightly to 15.2 months. This is a reversal to last year's findings when on average the time taken to resolve disputes had increased. Overall, the volume of construction disputes stayed the same compared to last year. Even though the average value of disputes decreased, we are noticing there are still large construction programs ongoing in North America that are yielding larger dispute values.

Our research in North America indicated in 2018 that the construction industry remained extremely busy, as the United States Department of Transportation made available more than $63.5 billion in funds for major transportation infrastructure investments. There are several mega construction programs underway that top the $10 billion mark. For example, the Port Authority of New York and New Jersey embarked on the Gateway Program, a rail expansion between New Jersey and New York with projected costs up to $12.9 billion. On the West Coast, California High-Speed Rail is estimating construction costs at completion for their program to approach $100 billion.

With infrastructure topping the list for disputes in last year's report, the building market moved into the top spot for 2018. Major building projects across the country are in full swing and projects such as New York City's Hudson Yards development and the Transbay Transit Center in San Francisco are well into construction. These are just a couple of examples of the building market in North America from East to West Coast.

Some owners in the region have been employing more proactive measures upfront on their construction projects, and many contracts now require more sophisticated project controls methods. Knowing that change orders often create delays and inefficiencies which can lead to disputes, risk identification early in the construction process has been successful for many projects in North America. The resulting risk mitigation strategies have proven to reduce the likelihood that the construction project will end in a dispute. In North America, we have seen a trend toward utilizing risk management techniques and contract-mandated early dispute resolution forums. In addition, we have seen project participants beginning to realize that going to litigation is not a winning solution.

| DISPUTE VALUE (US$ MILLIONS) | LENGTH OF DISPUTE (MONTHS) | ||||||||||||||

2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | |

North America | 10.5 | 9 | 34.3 | 29.6 | 25 | 21 | 19 | 16.3 | 14.4 | 11.9 | 13.7 | 16.2 | 13.5 | 15.6 | 17.7 | 15.2 |

2018 RANK | DISPUTE CAUSE | 2017 RANK |

1 | Errors and/or omissions in the contract document | 1 |

2 | Owner/contractor/subcontractor faiLing to understand and/or comply with its contractual obligation | 3 |

3 | Poorly drafted or incomplete and unsubstantiated claims | New in 2018 |

2018 RANK | MOST COMMON METHODS OF ALTERNATIVE DISPUTE RESOLUTION | 2017 RANK |

1 | Party-to-party negotiation | 1 |

2 | Mediation | 2 |

3 | Arbitration | 3 |

4 | Dispute adjudication board (tied with 3) | New in 2018 |