North America

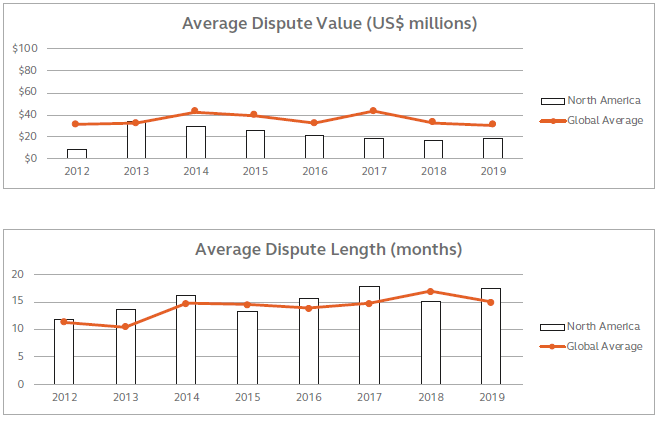

Dispute values, durations and volume all increased over the past year in North America. After continuously dropping since 2013, the value of disputes rose from $16.3 million to $18.8 million. The average time taken to resolve construction disputes for North America increased from 15.2 months in 2018 to 17.6 months in 2019. Overall, North America saw the volume of construction disputes increase compared to 2018, and the majority of participants in our survey expect this number to increase in 2020. With COVID-19's impact on the construction industry, we expect a further increase in claims related to delays and increased costs on projects. It is very difficult to predict the true widespread impact of this global pandemic, but with construction projects shutting down in some areas of North America, we know that projects will experience delays and disruption.

Construction continued to boom across North America in 2019 and, according to Engineering News-Record, the construction industry witnessed record growth in megaprojects. Many North American survey respondents are working on larger disputes than ever before - the highest value dispute our team worked on in North America was $1.5 billion. Consistent with findings in 2018, the buildings sector in North America saw the most disputes for 2019. This sector includes education, healthcare and real estate development.

For North America, the 2019 results show that the greatest effort was spent on avoidance and the most common form of early resolution was settlement prior to proceedings. The majority of survey respondents noted the most effective claims avoidance technique is risk management, followed closely by constructability reviews. Consistent with last year's findings, risk management techniques are being utilized to reduce the likelihood that a construction project will end up in a dispute. In North America many owners have embarked on larger capital programs. Knowing that larger programs can have produce more complex disputes, many owners in the region are making significant investments in claims avoidance techniques such as risk management workshops and extensive training to their project management staff.

It is very difficult to predict the true widespread impact of COVID-19, but with construction projects shutting down in some areas of North America, we know that projects will experience delays and disruption.

2019 RANK | MOST COMMON DISPUTE CAUSES | 2018 RANK |

1 | Contractor/Subcontractor failing to understand and/or comply with its contractual obligation | 2 |

2 | Errors and/or omissions in the Contract Document | 1 |

3 (three-way tie) | Poorly drafted or incomplete and unsubstantiated claims (tied at 3) | 3 |

Owner directed changes (tied at 3) | New ranking in 2019 | |

Unrealistic contract duration or completion date (tied at 3) | New ranking in 2019 |

2019 RANK | MOST COMMON METHODS OF ALTERNATIVE DISPUTE RESOLUTION | 2018 RANK |

1 | Mediation | 2 |

2 | Party-to-party negotiation | 1 |

3 | Litigation | New ranking in 2019 |

| DISPUTE VALUE (US$ MILLIONS) | LENGTH OF DISPUTE (MONTHS) | ||||||||||||||

2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | |

North America | 9 | 34.3 | 29.6 | 25 | 21 | 19 | 16.3 | 18.8 | 11.9 | 13.7 | 16.2 | 13.5 | 15.6 | 17.7 | 15.2 | 17.6 |