GLOSSARY

Considering the diversity of country approaches towards infrastructure and PPP projects, here we outline the most general and relevant to many countries notions for mutual understanding. Where the following terms appear in the Report, they are to be understood according to the definitions below:

refers to a difference between estimated global needs in infrastructure investment and projected global infrastructure investments. |

is a strategically planned network of high quality natural and semi-natural areas with other environmental features, which is designed and managed to deliver a wide range of ecosystem services and protect biodiversity in both rural and urban settings. |

is a long-term contract between a private party and a public entity, for providing a public asset or service, in which the private party provides financing and bears significant risk and management responsibilities. Privately financed infrastructures are of two types with respect to their funding structure: the concession, in which the end-users bare the core of the payment cost of the infrastructure (user-pays PPPs), and the government-pays PPPs, in which the taxpayers bare the core of the payment cost.i |

is such form of PPP wherein the government grants the private sector the right to finance, build, operate and charge public users of the public good, infrastructure or service, a fee or tariff which is regulated by public regulators and the concession contract. |

is such form of PPP wherein the government grants the private sector the right to finance, build, operate and provides government funding as a fee for the private partner to compensate for the costs of the latter. |

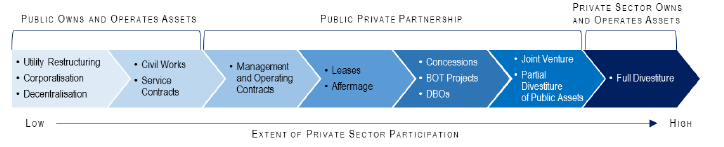

PPPs vs other infrastructure projects

financing of a PPP project refers to raising money upfront to pay for the design, construction, and early operational phases of an infrastructure asset, whether through debt or equity instruments of a public or private nature. This responsibility is ideally the role of the private partner, even if the government provides some type of support. The private partner will only provide financing in the expectation that it will be repaid, including a rate of return commensurate with the risks borne.ii |

funding of a PPP project refers to how investment and operational costs are repaid over time to compensate for the costs of the private partner that provides debt or equity for the project. Ultimately, public infrastructure can only be paid (1) by users of the infrastructure through direct user charges, such as tolls in the case of highways; or (2) by taxpayers through the government's periodic payments to the private partner.iii |

is a list of projects being considered by the government for implementation as PPPs in a specific time frame. |

is an organisation that has been set up to carry out functions concerning PPPs, including policy guidance, technical support, capacity building, PPP promotion and investment. |

is a combination of legal, regulatory, institutional and financial provisions that together facilitate the implementation of PPPs. |

refer to legislation designed to support and regulate PPP transactions and programs. |

is a codified system of law which is generally more prescriptive than a common law system, the judge's role is more significant, and the parties to an agreement typically have less freedom to contract. |

is a system that is based on precedents set by past court decisions. Parties under a common law system typically have more freedom to contract. |

refers to investments in a project on a site that has previously been used for industrial purposes or has been occupied by significant buildings. |

refers to investments on sites that have not been previously used for industrial purposes or have not been occupied by significant buildings. |

In the BOT framework, a third party, for example, the public administration, delegates to a private sector entity to design and build infrastructure and to operate and maintain these facilities for a specified period. During this period, the private party has the responsibility to raise the finance for the project and is entitled to retain all revenues generated by the project and is the owner of the regarded facilities. The facility will be then transferred to the public administration at the end of the project agreement. |

A BOOT structure differs from BOT in that the private entity owns the works. During the project period, the private company owns and operates the facility with the prime goal to recover the costs of investment and maintenance while trying to achieve a higher margin on the project. |

In a BOO project, ownership of the project usually remains with the project company, such as a mobile phone network. Therefore, the private company gets the benefits of any residual value of the project. |

Under BLT, a private entity builds a complete project and leases it to the government. On this way, the control over the project is transferred from the project owner to a lessee. In other words, the ownership remains by the shareholders, but operation purposes are leased. After the expiry of the leasing, the ownership of the asset and the operational responsibility are transferred to the government at a previously agreed price. |

Design-build-finance-operate is a project delivery method similar to BOOT except that there is no actual ownership transfer. Moreover, the contractor assumes the risk of financing until the end of the contract period. The owner then assumes the responsibility for maintenance and operation. |

This option is standard when the public party has little knowledge of what the project entails. Hence the public contracts the project to a company to design, build, operate and then transfer the corresponding assets. |

Under this model, a private entity is entrusted to design, construct, manage, and finance a facility, based on the specifications of the government. Project cash flows result from the government's payment for the rent of the facility. |

refers to a PPP in which the revenue of the Private partner is in the form of budgetary payments that are made when the infrastructure is ready and built in compliance with agreed performance standards. |

refers to a PPP project in which the revenues for the Private partner are based on user- payments, for example, tolls for a road. |

refer to payment obligations which timing and amount are contingent on the occurrence of a particular discrete/uncertain future event or series of future events. This Report applies this term, especially for those liabilities that affect the government under a PPP contract. The types of contingent liabilities that are relevant to governments in relation to PPP contracts are payment obligations under a PPP contract that are subject to the occurrence of certain events, such as termination. |

refers to arrangements in a PPP contract that determine what risks each party to the contract should be responsible for. Such arrangements have to ensure that a project satisfies the needs of the government, achieves value for money and is financially viable for the private sector. |

is an undertaking to fulfil the obligations of a third party in the event of a default. It may be limited in time and amount and may be callable immediately on default or only after the beneficiary has exhausted all other remedies. |

refers to a provision in a PPP contract when the government agrees to compensate an investor if actual project revenue falls below the specified threshold, thus mitigating the revenue risk taken by the private sector. |

is a proposal made by a private party to undertake a PPP project, submitted at the initiative of the private firm, rather than in response to a request from the government. |