Risk management

Collaborative risk management throughout the commercial lifecycle is essential to support successful project and portfolio delivery and sustainable outcomes. A portfolio view to risk and opportunity decisions can lead to better investment outcomes, allowing a coherent and consistent response to both common risks and successful treatment strategies (see chapter 1).

Risk management is the coordination of activities designed and operated to manage risk and exercise internal control within an organisation. A proactive approach to identifying and managing risks and opportunities using contracts effectively can drive improvement, innovation and value throughout the commercial lifecycle. We aim to work with our suppliers to get these things right:

• Identification and assessment, to determine and prioritise how risks should be managed.

• The selection, design and implementation of risk treatment options that manage risks to an acceptable level.

• The design and operation of integrated, insightful and informative risk monitoring.

• Timely, accurate and useful risk reporting to enhance the quality of decision-making and to support management and oversight bodies in meeting their responsibilities.

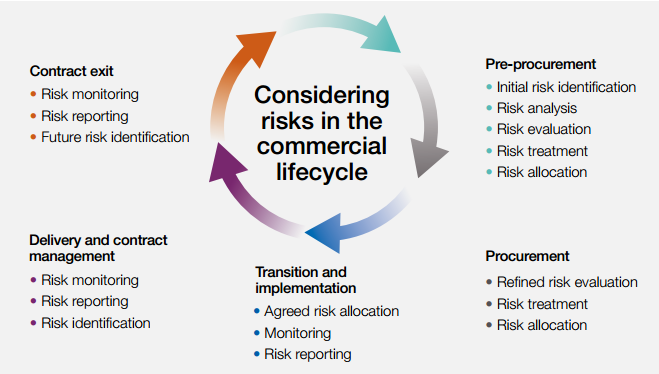

Risk management starts early in the project and commercial lifecycle through assessing market health and capability (see chapter 1), developing a clear specification (see chapter 3), delivery model approach (see chapter 5), contract design (see chapter 6), and continues through to contract delivery and exit (see chapter 12). Figure 3 sets out key steps in considering risk in the commercial lifecycle.

We recognise risks exist as a normal part of every project and programme and we cannot innovate without taking risks. Complex situations commonly require risk trade-offs which, when developing approaches, may include tolerated and accepted risks to achieve the optimal outcome. The key is to have joined up, transparent mechanisms to identify and handle foreseen and unforeseen risks and opportunities when they arise.

Figure 3. Risk in the commercial lifecycle