3 Prematurely announced projects are riskier

As a project evolves, the cost estimates evolve too. The cost estimates of big projects, in particular, change from first announcement to strategic business case to final business case to planning application, procurement, awarding of the contract, and finally to the ultimate cost of the completed project.

When a project is announced early, before a formal commitment such as a funding allocation, this usually means its cost estimate is a preliminary one, and does not incorporate a detailed engineering design or feasibility assessment.

There would be no problem with such early announcements if Australia had a robust process for cancelling those projects that, on closer examination, turned out not to be worth building, or not the best option available. But we don't have such a process; once a project is announced, it usually ends up being built. More than 80 per cent of projects that had an initial cost estimate of at least $20 million announced since 2001 were seen through to completion.71

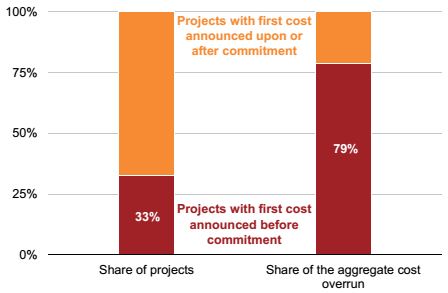

An announcement is premature when a government or opposition announces it will build a project for a particular cost, but the project does not yet have the regulatory and/or financial approvals that constitute a technical commitment, and which are needed before it can actually proceed. Premature announcements of this kind are not the norm.72 They occur about one third of the time, but they have been responsible for more than three quarters of the cost overruns over the past two decades (Figure 3.1).

Figure 3.1: Prematurely announced projects account for most of the value of cost overruns

Note: Includes all public road and rail projects costing more than $20 million that were completed between Q1 2001 and Q1 2020.

Source: Grattan analysis of Deloitte Access Economics Investment Monitor.

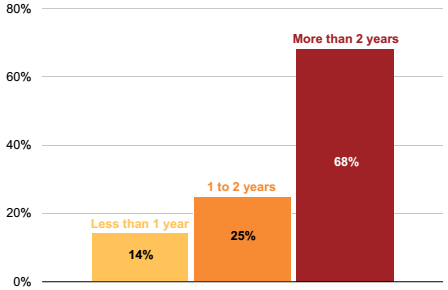

Projects with premature cost announcements exceed their promised cost by an average of 35 per cent; this is more than twice the percentage overrun (13 per cent) for projects that had their first cost announced upon or after commitment. And the more premature the announcement, the larger the overrun (Figure 3.2).

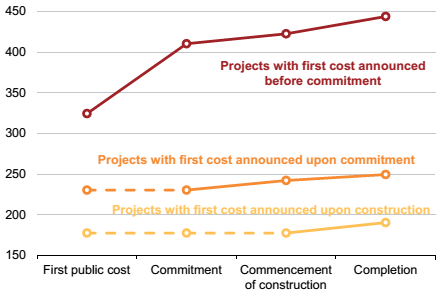

It might be hoped that floating a cost estimate early in the process would trigger the necessary refinements to the expected cost in the lead-up to commitment, so that the cost estimate at the time of commitment would be more accurate than for other projects. Unfortunately this is not the case. While the cost estimate for a prematurely announced project increases by an average of 18 per cent by the time it is formally committed, it doesn't end there; the cost estimate then increases again by a further 16 per cent on average by the time the project is completed - slightly higher than the 13 per cent average overrun for projects that have their first cost announced upon or after commitment.

Premature announcements often go hand in hand with larger projects.73 Almost half of the projects initially expected to cost $500 mil-lion or more in today's dollars had a premature cost announcement. Figure 3.3 on the following page shows that prematurely announced projects are haunted by cost overruns throughout their life, and that these projects started out substantially bigger, on average, than those projects announced in a more orthodox way.

Figure 3.2: The earlier the first cost announcement, the larger the overrun

Average change in cost as a percentage of initial project costs, by length of time between first cost announcement and commencement of construction

Note: Includes all public road and rail projects costing more than $20 million that were completed between Q1 2001 and Q1 2020.

Source: Grattan analysis of Deloitte Access Economics Investment Monitor.

Figure 3.3: Projects with premature cost announcements are haunted throughout their lives

Average project size by project stage, $2020 million

Note: Includes all public road and rail projects costing more than $20 million that were completed between Q1 2001 and Q1 2020.

Source: Grattan analysis of Deloitte Access Economics Investment Monitor.

____________________________________________________________________________

71. Based on the shares of projects listed as 'Completed' versus 'Deleted' in the Investment Monitor historical record. The share of projects 'Completed' may be an underestimate of the actual share of projects that get completed because the Investment Monitor wraps some 'Deleted' projects into broader projects. On the other hand, it's possible that a higher proportion of the 'ongoing' projects will end up being deleted. If this is the case, the share of projects 'Completed' may be an overestimate of the actual share of projects that get completed.

72. For the analysis in this chapter we have defined a first cost announcement as 'premature' if the accompanying status in the Investment Monitor is 'Possible' or 'Under consideration' (and not 'Committed' or 'Under construction'). Once projects reach the 'Committed' status they 'have received the necessary regulatory and financial approval' according to the definitions and classifications document that accompanies the Investment Monitor.

73. Despite projects with premature cost announcements being larger on average, there are still poor cost outcomes among smaller projects with premature cost announcements. For projects with an initial cost of up to $100 million, the average cost outcome for projects with a premature cost announcement was a 33 per cent overrun, compared to a 17 per cent overrun on projects without a premature cost announcement.