3. Concurrent Challenges

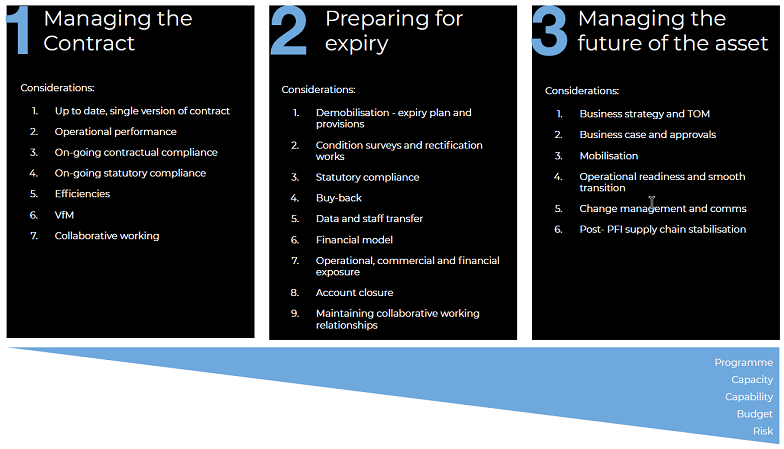

It is becoming widely accepted that collaboration is key to a successful PFI expiry, and that a collaborative handback process should be developed and appropriately resourced, commencing at least 5-7 years before expiry. Local Partnerships (LP) believe that contract expiry should be a positive experience.2 It is recognised, however, that even the best providers and authorities with excellent relationships will need to address a myriad of issues, spanning three concurrent workstreams:

The Scottish Futures Trust (SFT) has released excellent programme guidance on the expiry process, covering each of these workstreams. The guidance includes the need for early collaborative engagement, on-going contract management, future use, leases, condition surveys, asset and risk registers, O&M documentation, statutory obligations, etc.3 Importantly, the SFT makes the valuable point that the participants need to treat the handback process as a project and ensure that appropriate governance and sufficient resources are in place.

And, of course, the Infrastructure & Projects Authority (IPA) is currently resourcing and actively engaging with key stakeholders to ensure that PFI contracts are currently being managed in accordance with their terms, to ensure the taxpayer is obtaining the contracted VfM, while at the same time planning 5-7 years ahead for a seamless transfer of the assets into a post-PFI operating model, with no business disruption.

It is encouraging that the NAO, IPA, SFT and LP are all focused on the importance of ensuring successful expiries and appear to have a common approach to meeting these concurrent challenges.

An early challenge to be addressed is ensuring that the assets are being well maintained throughout the contract life and are in a good condition. The way this challenge is addressed can dramatically impact the later challenges to be faced.

Of course, contracts should be managed throughout their life-term to ensure, inter alia, that SLAs and KPIs are being met and the right operational performance and value for money is achieved, but this is especially important as expiry approaches and the assets are due to be handed back. A review at the early stage of the expiry process is a great way of baselining and protecting the service on mutually understood terms, before addressing the challenge of operational and commercial transition. Both Contracting Authorities and PFI Providers should know what it takes to achieve the right performance and commit to one another to sustain that right up until the point of expiry, before addressing the challenge of how to work through exit obligations and manage the transition.

It is important that the contract reviews are done collaboratively between the Authorities and the PFI providers. It is accepted by everyone involved, equity investors, SPVs, OpCos, Authorities and public sector service users that PFI providers should be on top of their contracts and complying with their obligations. A starting point to reviewing the PFI contract is to have an up-to-date version: a single version of the truth for all stakeholders. The NAO notes that the PFI contract is central to preparing for and managing the expiry process and that it can take a considerable amount of time to gather together the PFI contract and all its amendments. Once the up-to-date version of the contract is available, it is important that demonstrating compliance is supported by evidence.

In undertaking the exercise of ensuring contractual compliance, the parties ideally should agree on the purpose of the exercise. Is the prime objective to:

a) Ensure that the assets are in the condition required by, and being managed in accordance with, the contract; or

b) Achieve the maximum financial penalties that the Contracting Authority is able to claim?

The answer to this question, which will often be some years ahead of the expiry date, is likely to significantly impact the relationships between the parties. If the process is seen by either party as a means of catching the other out, then a breakdown in relationships is highly likely. For example, the exercise ought not be seen by Authorities as an expedient means of obtaining maximum cash savings on claims relating to trivial operational non-compliance.

Equally, it should not be exploited by PFI providers to compromise service or maintenance for the sake of short-term profit.

Where these things happen, relationships will fail before the really challenging aspects of expiry need to be faced. We know from the NAO review that a third of respondents expect to have to use the Dispute Resolution Process (DRP). The proportion with the fatalistic view that DRP is necessary will only increase if the early onset of the expiry process is characterised by cynicism and mistrust and/or seen as a zero-sum game rather than pursuit of a win-win outcome.

____________________________________________________________________________________________

2 Local Partnerships 'Preparing for the Expiry of Private Finance Initiative Contracts - Managing PFI assets and services as contracts end' (June 2020)

3 Scottish Futures Trust 'PPP Projects Nearing the End of Contract: A Programme Approach' (15 April 2020)